Why data will define value for insurers - and how to harness its full potential for success

Data is now a critical asset for insurers, driving personalized experiences and competitive advantage. Discover how modernizing data strategies can help insurers stay competitive and deliver exceptional customer value.

Omnichannel engagement platforms

Boost customer loyalty with omnichannel platforms

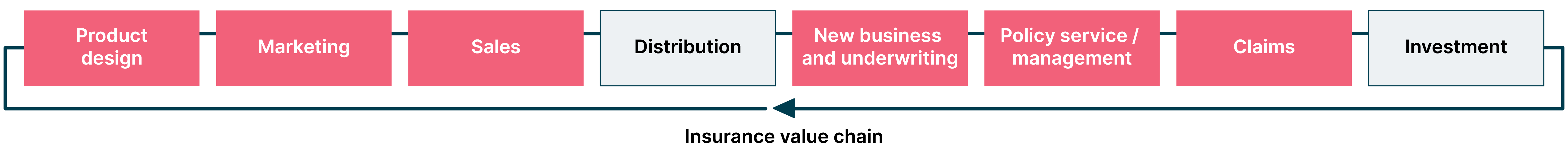

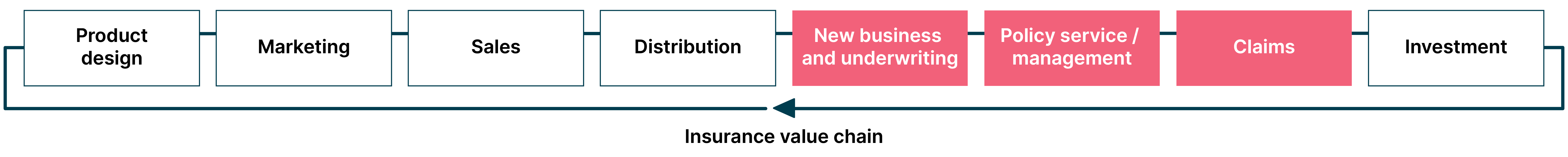

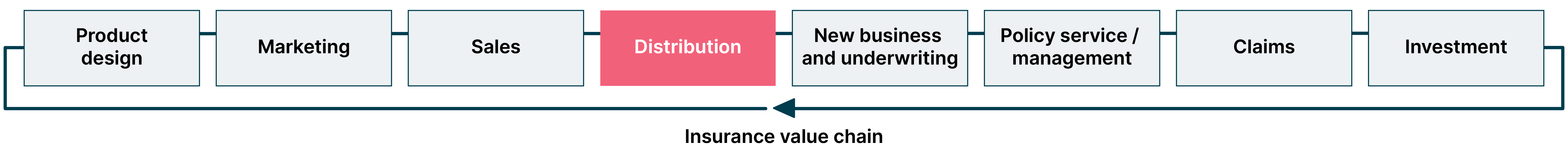

We help you to build seamless omnichannel engagement platforms across the entire insurance value-chain. Empower your customers with simplified applications, easy access to information, simple claims submission, and timely notifications. This approach leverages Data Mesh principles such as decentralised data ownership, enabling more efficient access to insights, better decision-making across the organization, and enhanced operational efficiency—helping you stay competitive while making life easier for your customers.

Seamless customer engagement across physical and digital channels

Virtual office platform

Differentiated user experience

AI-based personalization engine

Digital underwriting

Automated business rule engine (BRE)

Chatbots and virtual assistants

Digital claims management

Policy servicing “First Time Right” (FTR)

Omnichannel analytics

Unified data platform

Operational transformation

Enhance efficiency with operational transformation

With our support, you can modernize legacy systems and digital insurance platforms to increase ROI with integrations across the whole insurance value chain. Partner with us to facilitate faster claims processing, streamline workflows, ensure compliance with audit trails, and integrate third-party services. We help you adopt AI automation to enhance customer service across the claims lifecycle for a better customer experience.

Streamlining insurance operations

Open insurance framework

Unified customer communication

Legacy modernization

Embedded insurance

Predictive analytics

Back office transformation

Claims automation and straight-through processing (STP)

Policy Servicing “First Time Right” (FTR)

Process transparency virtual office

Employee talent and skill enablement

Distribution empowerment

Meet customer needs with distribution empowerment

Empower your advisors to focus on what really matters. We support you in building modern platforms that give your advisors the freedom to meet the changing needs of your customers, optimizing every touch point from marketing, through to sales and distribution. By adopting a human-centered approach, we enable your advisors’ roles to evolve, enhancing efficiency and improving the customer experience.

Streamlining insurance distribution

Expedited partners’ onboarding - virtual office

Product customization

Personalized recommendations

Sales and partners’ support

Lead management

Partners’ training and development

Performance monitoring

Rewards and compensation

Chatbots and virtual assistants

Role-based partner access

If you stand back and you think about what we have achieved over that period of time, it's jaw dropping. We have mobilized one of the nation's most traditional, historical businesses. We have created an extraordinary amount of capacity to deliver in a lean and agile way, and I have to thank Thoughtworks for that.