Will credit cards become a thing of the past?

In this article, we look at the genesis of credit cards, how the industry in Australia is faring today and the players that are transforming the future of credit. Plus, we look at how collaboration between the players in the ecosystem (schemes, banks, fintechs, merchants and processors) has evolved.

A brief history of credit cards

There was a pivotal moment in history in September 1958 which forever changed the need for cash in society. The renowned Bank of America launched BankAmericard, the world’s first most successful modern day credit card. This card succeeded where others failed by breaking the ‘chicken-and-egg’ cycle; consumers did not want to use a card that few merchants would accept and merchants did not want to accept a card that few consumers used. BankAmericard was eventually licensed to other banks around the United States and then around the world, and in 1976, all BankAmericard licensees united under the common brand Visa.

In Australia, credit cards were first introduced in 1974 by Bankcard. Soon after, Commonwealth Bank released its own version of a credit card. Since then, credit card use has grown at an exponential rate. Today there are 15 million personal cards in Australian customer’s (digital) wallets and outstanding balances have grown from a modest $2.5 bln in 1985 to $46 bln in 20181. During this period, the average credit card debt has increased from $160 to $2000.

The state of Australia’s credit card industry

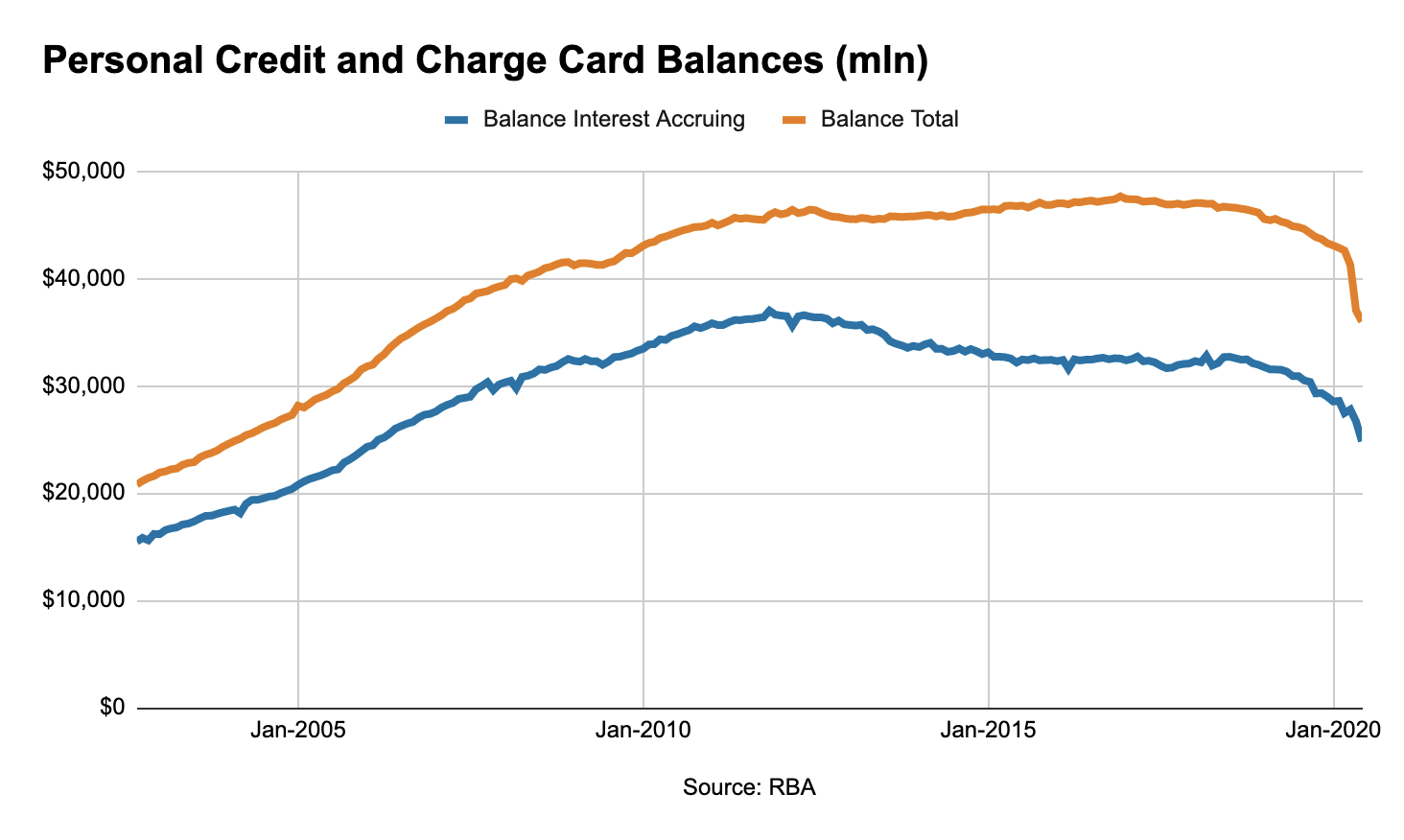

The credit card industry in Australia saw decades of growth, however, according to the Reserve Bank of Australia (RBA), outstanding personal credit card debt contracted by 20% from $45 bln to $36 bln between May 2019 and May 20202. Interest accruing balances also fell by almost 20% since last year3. In fact, interest accruing balances have been falling over the last 8 years, from $36 bln to $24 bln today. One reason for this is that the industry has been quite active in promoting interest free balance transfers. In addition, customers have become more aware of the high interest rates on credit cards leading to more on-time repayments.

Despite this, however, credit card transaction volume (debit and credit) has gone up. This comes down to the fact that credit cards still provide consumers with convenience; it is widely accepted as a payment method in stores, both online and in physical stores. Today, there is hardly any real reason to keep cash in your wallet. Use of cash is now mostly habitual, and in only some cases, because there is no alternative. A credit card also provides (revolving) credit and therefore defers the payment for the card holder.

In addition, new credit offerings based on credit cards have been introduced when retailers started to partner with credit card issuers like HSBC (e.g. Bing Lee, Webjet) and financial institutions like Latitude (e.g. Harvey Norman, JB Hifi) and FlexiGroup. For example, when a JB Hifi customer buys a TV at 60 months interest free, the underlying product issued by JB’s financial partner, is still a credit card or sometimes a personal loan. The retailer pays the card issuer a percentage of the amount charged for the sold item.

Deferring payments is however something the ‘Buy Now Pay Later’ (BNPL) products have now revolutionized, giving consumers a simpler way to defer their payments and provide a more seamless customer experience online.

Buy Now Pay Later products on the rise

In the last couple of years, ‘Buy Now Pay Later’ (BNPL) products are making a big entrance and gaining widespread popularity as an alternative payment method. It is estimated that 5 million people in Australia and New Zealand are using BNPL services from Afterpay, Humm, Zip, OpenPay, Klarna and more4. Despite the fact that total outstanding BNPL debt is still dwarfed by credit cards and personal loans, BNPL is growing at a dazzling rate and is incredibly popular with younger generations.

A study on why Millennials and Gen Z generations are moving towards BNPL services, found that younger generations want to avoid high interest rates and fees of credit cards. In Australia, the credit card interest rate is still at 20%, despite the fact that the RBA’s cash rate has fallen by 7% to 0.25% over the last 10 years5. However, most BNPL offerings charge no interest at all. Furthermore the research showed that younger generations found the way credit cards work (e.g. fee structure, repayments) is more complicated than BNPL products.

Then there is the ease of signing up for BNPL services. Opening up an Afterpay account takes less than 2 minutes. ID verification is done instantaneously and not all BNPL products require a credit check, because BNPL is not regulated by the National Credit Act. Applying for credit cards is a more lengthy process which can often take days, sometimes weeks, to get approved. Moreover, younger generations also often can’t get approved for a credit card because they don’t have a credit history in order to be eligible. Lastly, the BNPL customer user experience via intuitive apps is much better than most credit card interfaces.

In summary, BNPL’s simplicity, transparency and ease of access trump credit cards.

Will credit cards soon become a thing of the past?

The simple answer is no. First of all, credit cards do have the advantage of having a significantly higher card acceptance at merchants globally. A BNPL customer is currently unable to pay at places like Woolworths or Coles for their everyday grocery shopping, or secure a rental car overseas. Visa and Mastercard have created a truly global point of sales and online payment ecosystem and their cards are accepted by more than 40 million merchants globally. BNPL providers have contracts with merchants in place that are a fraction of those. In addition, cross border payments with BNPL are not a reality yet.

Also when BNPL customers pay their instalments, the transactions are done via payment rails of existing schemes (VISA, Mastercard) or via a bank account (BSB and account number). This means the schemes are not completely taken out of a BNPL transaction.

Lastly, the credit card industry introduced rewards programs that have many Australians hooked. Especially partnerships with Frequent Flyer programs with airlines like Qantas and Virgin (Velocity) are still popular, despite these programs having been devalued because of diminishing interchange revenue.

Overall, credit cards still deliver value to the customer and therefore will not become obsolete in a hurry. But the pressure is certainly on.

The future of credit, what’s next?

We believe the payment and unsecured credit providers in the ecosystem will benefit from forming partnerships to leverage each other's strengths. We are already seeing this with banks like Commonwealth Bank partnering with the Swedish BNPL provider Klarna. From this, consumers can expect to see more ‘hybrid products’, which will combine all the benefits of both credit cards and BNPL products.

We’ll also see the continued rise of BNPL providers as they create a wider network of merchant partnerships, but also because BNPL will go to ‘open loop’, facilitating BNPL payments at merchants where a contract is not in place. Also partnership agreements between the schemes and BNPL providers are starting to emerge (eg. Splitit and Mastercard).

The advent of Open Banking also opens up the opportunity for banks and their partners to collaborate and deliver new products and experiences for the customer such as prefilled applications, bespoke products and tailored experiences suiting individual customer needs, by sharing each other’s data.

Longer term credit products could also one day become almost ‘invisible’, with no upfront application process. Products that are powered by Open Finance and Consumer Data Right could provide instant credit to the customer given their ability to repay, in real time, at the point of purchase. These could also help customers accrue and monetize loyalty points across transactions, irrespective of the merchant. Merchants will then have access (permissioned) to customer data from a bi-directional marketplace, being able to spin up products that deliver value to specific customers.

Summary

We moved to a payments and credit ecosystem that has become digital, real time, data-rich and more frictionless for the end-consumer. The manual processes that characterized the past - handling cash, customers filling in paper forms, bank tellers assessing your creditworthiness based on human underwriting skills - have moved to digitized payment options, improving the application approval time from weeks to minutes. Credit assessment evolved from a painstaking lengthy process, often with human intervention, to automated, instant decisioning supported by analytics and credit modeling. The latter will be even further advanced by Consumer Data Right and Open Banking.

Our view is that the ecosystem will benefit most from all participants working together. Fintechs and large organisations partnering together is often the fastest and most cost-effective way to test new market propositions, enhancing customer experience at scale.

True winners in the long term, will be the organisations who recognize the value of customer data, and monetize data to provide data-led, frictionless and tailored experiences.

1. https://www.finder.com.au/credit-cards/credit-card-statistics; https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

2. https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

3. https://www.rba.gov.au/payments-and-infrastructure/resources/payments-data.html

4. https://www.savings.com.au/buy-now-pay-later/nearly-5-million-customers-using-afterpay-zip-in-australia-and-nz

5. https://www.rba.gov.au/chart-pack/interest-rates.html

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.