Financial Services 2025: 3 Core Principles to Unlock Growth

If you lead a traditional investment management organization, the storm surrounding the industry may look and feel like what the music and media industries have been facing for 15 years.

The transition from disks to downloads and streaming have transformed the music industry. We are witnessing a similar seismic shift that will reshape the century-old banking business model. Changing customer expectations across generations, and the rapid acceleration of automation throughout the entire value chain will put pressure on long-standing sources of revenue, growth, and retention.

This is part three in a four-part series. Read Chapter 1 - How to Grow in the Challenging Years Ahead and Chapter 2 - Eight Strategic Forces That Are Transforming The Industry.

Eight strategic forces will transform existing organizational structures, governance processes, capital requirements, product development, investment strategies, marketing, distribution and more. Your Board, analysts, and peers are pushing you to exploit emerging opportunities, and mitigate latent threats.

The pressure to react is already forcing strategic detours for many large companies. One investment management company chose to refocus all of its discretionary spend towards automating compliance, instead of customer engagement. Others are spreading their investments to address many of the strategic forces simultaneously: unfortunately thin, short-term focused, and lacking any integration across efforts.

For courageous executives who can chart a different yet holistic course, these fragmented investments across the industry landscape have created a unique, game-changing opportunity to capitalize and create competitive advantage for their firm.

We discussed the first stage of this course in Chapter 1: becoming a truly customer-driven organization, across all functional areas of the business. In Chapter 2, we discussed the nature and implications of eight stategic forces if companies continue to run business as usual.

Organizations need to become truly customer-driven across all functional areas of the business. To unlock growth, companies need to think through how to place the customer at the center of all decisions.

Three Core Principles to Unlock Growth

In an environment of persistently low interest rates and a lack of a global growth engine, true organic growth must come from either taking market share from competitors or growing a new customer base not currently engaged with the financial system. That means companies must focus on increasing wallet share and new customer acquisition as clear leading indicators.

However, new customers lack trust1 in the intentions or the core value proposition of existing financial institutions. Customers feel very underserved, yet they are eager for advice.

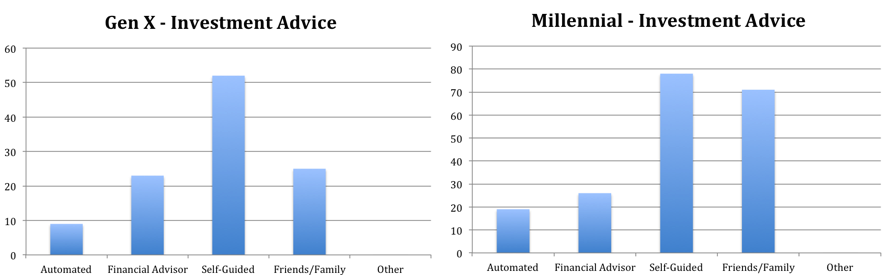

In a survey of over 210 highly compensated, tech-savvy professionals, where 124 (60%) were millennials, we discovered that both Gen X and millennial investors were largely self-guided in their investment decisions. Both demographic segments saw a high degree of dependence on friends and family for financial advice—an indication of trust and social capital enjoyed by friends and family when it comes to one’s well-being.

Millennials seek advice, but from trusted sources

*If you would like to participate in this survey, click here. We would appreciate your input!

Given the cohort’s average income and savings rates, most of our respondents would qualify for the advice channel. Yet less than 35% of Gen X respondents employed a financial advisor. For millennials, it was even lower—only 30% had financial advisors.

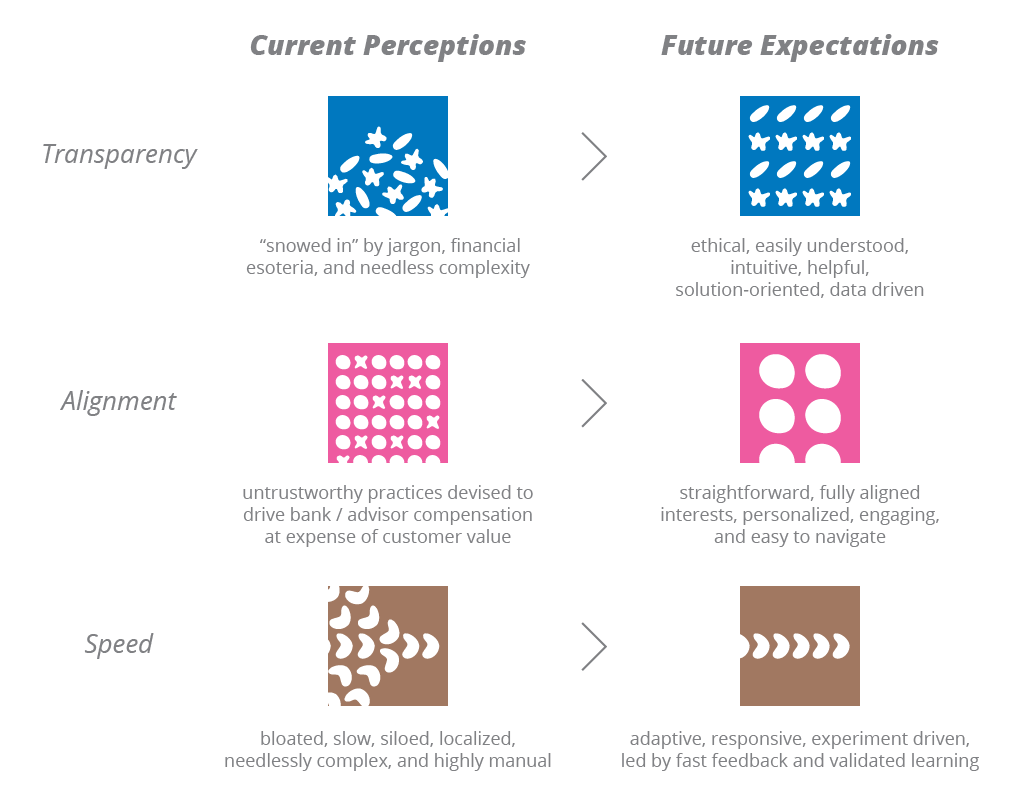

When asked why respondents did not employ a financial advisor, the near -universal response was a lack of trust in a financial advisor’s motivations and incentives.

For companies, a major opportunity for organic growth is directly tied to closing the trust gap companies have with their customers.

To address this trust gap, leaders must refocus their efforts to address the root causes head on: How might we create an organization and value proposition that delivers remarkable customer value? How might we remove the pervasive unease felt by weary investors who fear brokers with dubious interests?

Traditional companies must create the conditions in which digitally savvy investors want to engage with them, not bypass them. The three core principles that unlock growth by addressing the root causes of the trust gap are:

A clear pattern arises: the fastest growing companies, and those that are given a premium by investors (among public companies), are those that exhibit these three characteristics.

Take Vanguard and Blackrock: both unequivocally state that they stand on the side of investors. Over the past two years, they have received the largest inflows in history, at the expense of other asset managers who have failed to earn the trust of either retail or institutional investors. The market has rewarded their focus on transparency, alignment, and speed: as a public company, Blackrock has earned a substantial valuation premium compared to its peers.

Converting Principles into Action

Leaders simply do not have a playbook to drive growth in this new environment. While visits to Silicon Valley’s “established upstarts” and viewings of TED-like videos may surface new possibilities, the absence of an well-understood direction prohibits them from embracing the uncertainties involved in this journey.

With customer needs (current, emergent and unexpected) as their strategic focus, traditional companies can transform from carrier to battleship and leverage scale for new growth. We see a gradual but sure evolution of customer-driven operating models for running financial services businesses across the globe.

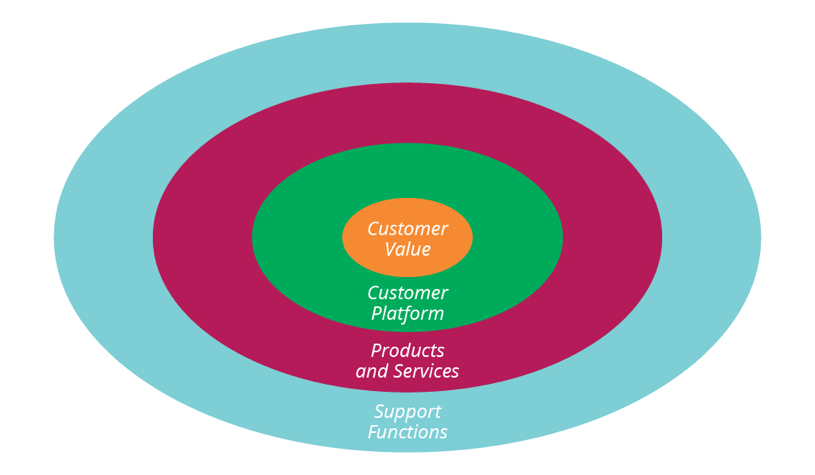

Imagine a digital customer platform focused on delivering great experience and value for customers, retail or institutional, across existing and new distribution channels. Much like what Apple did with the AppStore and iTunes model, the platform can potentially curate third-party partner products and services and establish you as an ecosystem player. Support functions like compliance, regulatory reporting etc. will align to help create products and services and deliver unique value to customers to start-up speed.

This is not a pipe dream. New ventures2 are using their high valuations to invest in technologies and processes to earn customer trust and deliver exceptional market-defining value. Few traditional, large organizations3 around the world are undergoing such transformations to become more customer-led, while learning how to become better at this craft. The winner will be judged by their congruence of transparency, alignment and speed.

Image: a conceptual customer led operating model for your business with customer value at the center.

Here are a few different ideas that illustrate how banks can employ these principles in new ways.

- Imagine a curated, service-based experience that addresses the growing number of customers who would value a bespoke experience sitting between your advised and self-directed channels.

- Transform your current brokerage platform into a holistic, integrated, highly personalized financial hub that can be tailored to key scenarios for both retail and institutional investors.

- Expand your existing middle office platforms through APIs to partner with other ecosystem providers, creating new opportunities for your product teams.

A true customer-led operating model, where support functions focus on delivering unique customer experiences across all channels, will help to attract like-minded employees, help create a favorable public image for the organization, and potentially make regulator relations less fraught with risk.

To convert these core principles into action:

-

Transform your organization into a customer-first, outcome-oriented growth engine. Align all functional areas, from front-office through back, including technology, into cross-functional teams that are all measured by customer-driven outcomes.

This is not about creating a separate innovation unit and running experiments at the periphery. This is more foundational transformation to deliver new value to customers, faster.

We are witnessing a growing appetite among senior leaders to shape organizations that can move at startup speed, using Lean Enterprise principles as their guideposts. We are working with a number of large, global investment management companies to help them transform into adaptive, responsive, outcome-driven enterprises that put their customer’s needs first.

-

Build better products that create new customer value, faster. In today’s hyper-competitive world, cycle times for new product-service innovation are continuously compressing. No organization can survive competition without committing to lean and continuous innovation cycles, with customer feedback and analytics driving the next best decision.

Digitally native enterprises are known for adopting “lean startup” principles to deliver services that delight customers, better, faster and cheaper.

The same principles can be adopted by traditional financial services companies. One of Australia’s largest financial services firms has reduced their idea to market cycle time from 25 months to eight, enabling them to better understand, and serve their customers with new, innovative offerings.

Get started with our recommendations in one of our previous articles.

-

Scale nimble, new customer-facing platforms to create new competitive advantage. The barriers to entry for a new digital investment management firm have never been lower. What new players lack is incumbents’ scale, trust, and deep pockets, the most important ingredients in achieving profit growth.

Leverage modern and emerging engineering and architectural practices that deliver speed and flexibility, and marry them to your scale, trust and point-of-view on investments. Loosely decoupled platforms that can quickly adapt to new ideas and emerging capabilities will create new opportunities for growth.

In an ongoing engagement with a large multinational card services firm, our teams are rapidly building a new global private card platform, creating the opportunity for a highly scalable business model with industry-leading flexibility.

Turn your scale into a platform, creating a force-multiplying effect, so that you can be one of the “winners that take all”. In the future, winners will be the ones with the most highly adaptive platforms that can be multi-purposed to exploit existing and new economies of scale.

Courage, ambition and perseverance are the only prerequisites for these tools and recommendations to work: the courage to pressure your current business model, the ambition to break out of inertia and the perseverance to follow the change through. In the end, these capabilities will help your company leap ahead of current and emerging competitors, and propel you to industry leadership.

Next week: Recommendations on Moving Forward

References:

1 - www.edelman.com/insights/intellectual-property/2015-edelman-trust-barometer/trust-across-industries/financial-services-path-to-building-trust/

2 - www.betterment.com/resources/inside-betterment/our-story/investment-safety-and-security-at-betterment/

3 - hbr.org/2015/01/ges-culture-challenge-after-welch-and-immelt

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.