If Amazon Could Fly. . .

Where do the boundaries of retail lie? This question has been on my mind a lot lately. With the proliferation of customer touch points and the transient nature of online buying behavior things are a little hazy!

This got me thinking about Amazon as they start the process of securing drone air space, something that was inconceivable just a few years ago (to date there has been almost £400bn funding in drones!). This only further highlights the breakdown of the traditional (perceived) boundaries between what we call ‘verticals’ or ‘industries’. It’s also fair to say that the accelerated speed of innovation has meant brand diversification and migration is moving at unprecedented levels.

Clearly a few robots flying by your office window doesn’t equate to the demise of commercial airline operations. However, if you consider Amazon has been growing its Travel product significantly over recent months, by deploying bespoke API’s to increase it’s overall distribution (in local accommodation), then it doesn’t take a rocket scientist (or a jet scientist to that point…) to join up the dots.

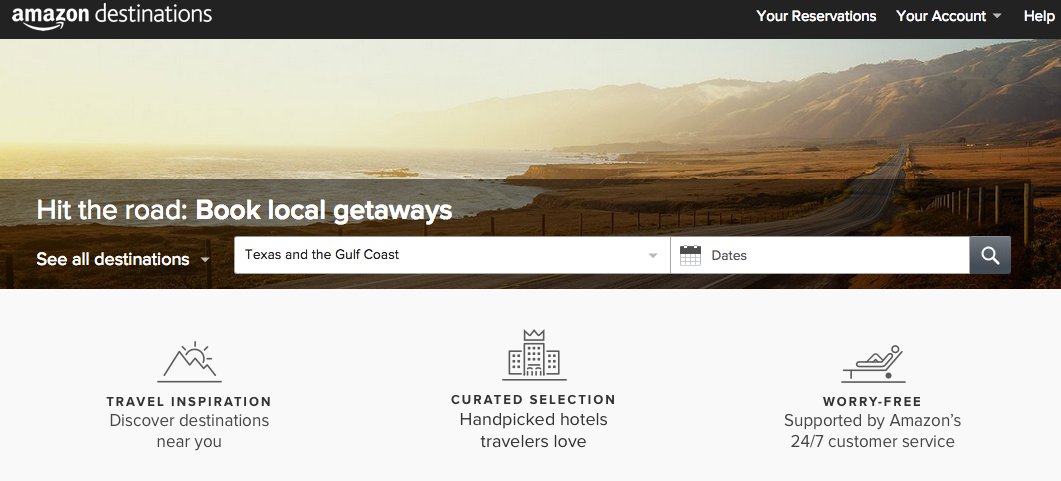

Above: Amazon Destinations recently doubled its hotel coverage.

Compound this with what has been happening up the road with that other cyber super-power Google and the point only gets reinforced further. They launched their ITA product years ago but have since struck up a deal with the Travel Industry stalwart Sabre that ties up 20,000 properties (nothing in terms of the Booking / Expedia volumes, but symbolic in many ways). Nothing is sacred as it were.

Back to Amazon and a point of reflection on their proposition known as Marketplaces. Not a new business model by any stretch but one that has not yet expanded beyond conventional consumer and distribution boundaries. Tesco have also had a go at this over recent years, with only limited success - lets see how that holds up under the current regime! Of course there is eBay and the newly rejuvenated Rakuten, not to mention the developing Marketplace proposition at ASOS. It’s also worth noting that beyond marketplaces companies like Tesco have diversified into banks, multiple forms of insurance and other related sectors. Indeed, closer to home (and getting back on the Airline thread) Virgin, many years ago, demonstrated how a brand can stretch into unrelated industries with the right level of drive, risk taking and entrepreneurship..

A point to consider here is how companies such as airlines with significant fixed assets (aircraft) and operating costs (Aviation fuel, airport costs, cabin crew etc.) can innovate at speed to keep up with changes in consumer travel expectations (and from adjacent invading sectors). How do airlines, simply put, turn their large fixed operating costs into a commodity and avoid becoming a dumb pipe!?

Airlines need to create platforms that take the spirit of marketplaces, providing a new generation of traveller the ability to create bespoke experiences. This will undoubtedly require collaboration with partners (existing and new) right across the travel eco-system (including retail).

As consumers get closer and closer to a single basket, the ability to gain control of the travel experience and customize it to their own needs will only increase. For legacy airlines, the complex operating systems that they are wired into will make change difficult. The IATA New Distribution Capability goes some way toward unlocking some of the shackles but there is still a long way to go. Maybe a fresh look at the overall asset utilization and new customer buying behaviors will result in a more virtual proposition moving forward. This may well require slicing of part of the current operation and trying something totally different.

What if Amazon Started an Airline?

Back to Amazon! They’re not that far off. They have the eco-system, they have the volume, they don’t have the legacy systems or the huge fixed assets. I’m not saying they should place a large order with Airbus or Boeing but if they are at the forefront of new forms of travel like Drones who is to say they won’t own that space and spread into others. Maybe they just need to get some shared access to some aircraft to prove the demand. From there who knows.

So what might an Amazon airline customer experience look like? Book Your Flight (from any airline at a time and location that suits you), access to in-flight connectivity to further feed our Amazon addiction, buy your digital books, gadgets and other holiday accessories, purchase what you need in the air and have it ready when you land. Oh, you can already get your accommodation through Amazon Destinations! They will have lots of solutions for destination services, ground transport etc. Sound inconceivable? I don’t think it does!

Existing airlines find themselves in a ‘make or break’ period. Their ability to innovate at speed will be critical. I often refer to ‘mind the gap’ where the speed of innovation in your external environment is faster than your own innovation speed – creating an innovation gap where you lose credibility and customers. It poses the question as to how your organisation structures itself to innovate at scale.

Such periods of intense change lead to new business architectures and will therefore drive airlines (in this example) to morph to stay relevant. Many of the concepts and methodology in ‘Lean Enterprise’ (O’Reilly 2015) reflect on how large organizations need to change their approach to innovation so they can be more market responsive and stay relevant for their customers. Creating new business propositions and new business organizations against the backdrop of rapidly changing consumer environments are at the heart of the challenges facing many large organizations. Such large changes need courageous leaders that embrace innovation and use technology to influence business change.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.