This article is intended for companies that have established themselves as strong brands in their area and want to grow their business into BFSI, much like Apple from the electronics industry has expanded into payments by relying on banks.

The intended reader has influence or determines the future strategy of the company, e.g., as a CXO, Business Unit head, or Product Manager.

Two main paths are explored and compared:

FinTech Forward

Building a Bank

Furthermore, this is intended to be a high level guide. We will dive deeper into the details and further information in due time with further articles.

The drivers

While there can be an array of drivers pushing this change, two of the common drivers are as follows:

Customer relationships. The company has a strong brand and loyal customer base in its area of business and foresees limited potential for growth in the same domain. This could be due to market limitations or macroeconomic conditions. Thus it wants to leverage its customer relationships and expand into the BFSI domain. E.g., John Deere for agri-tech.

Ownership. The company has third party vendors or agents enabling their value chains, but want to take ownership, for reasons of cost, complexity or customer value — even though the BFSI domain may be beyond their core competencies.

The strategy

Based on the analysis of various players in the BFSI industry, we have observed the following broad strategies for successful expansion into the world of BFSI:

FinTech Forward (Tech Up). Here the company offers financial services by relying heavily on technology.

Building a Bank (Suit Up). Here the company offers financial services or products by obtaining a license and becoming a bank.

Next, let us explore the further steps.

FinTech forward

A FinTech company is essentially one that relies on its technology expertise to provide solutions in banking and financial services. Even where it provides banking products such as loans or cards, it does so in partnership with a Bank, since it does not have a banking license.

An organization aiming to expand its banking and financial services and insurance (BFSI) portfolio must consider the following when the goal is to be a FinTech:

Market analysis. Find a niche area that your financial products can supply to. Consider the end-to-end value chain and focus on areas which can be owned, or leveraged with a third party vendor to cover. E.g., a smartphone company could offer affordable micro-loans to its customers for phone purchases, sponsored by a bank's balance sheet.

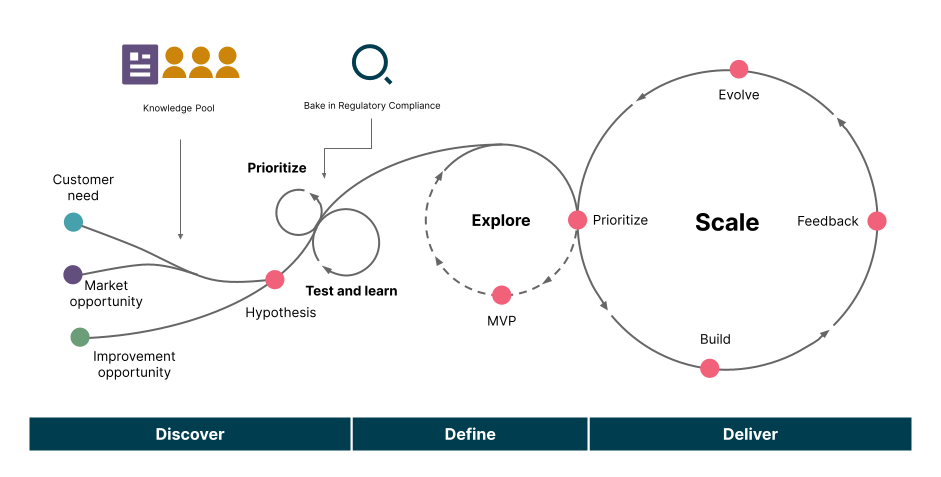

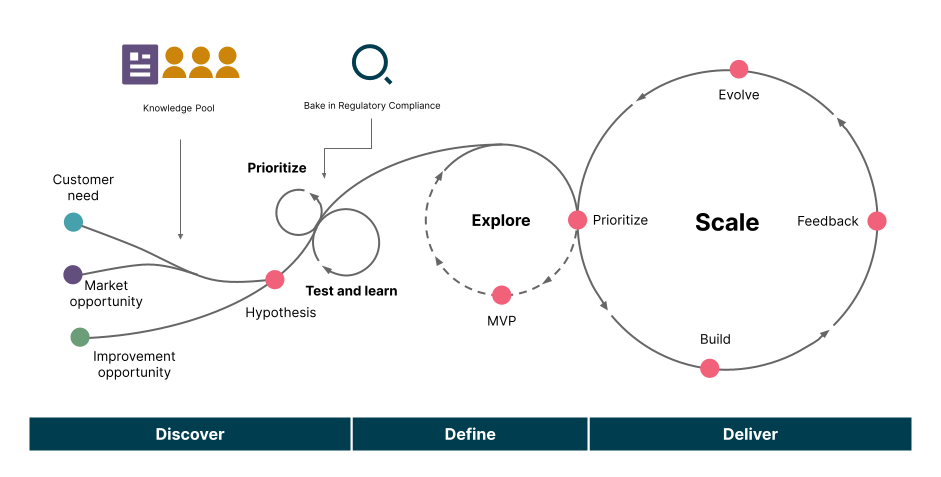

Build a knowledge pool. This domain requires expertise in banking and finance, tech and supporting areas like legal and compliance.

Vision to product. Once you have an eager customer-base and the right team, build your FS product — ensuring a great user experience, with compliance, security and regulatory adherence. It is strongly recommended to do so using the minimum viable product (MVP) methodology. It is important to explore the end-to-end value chain holistically and consider pockets of value that can be business opportunities.

Regulatory compliance. Depending on the region and demographic, your regulations may vary. It is important to research and ensure compliance. Leverage your Knowledge Pool.

Go-to-market strategy. Launch your product with effective marketing, gather customer feedback, and iterate. Leverage your success to expand into other FS areas.

Tech Up example: Apple’s affordable finance

Apple, a giant in the electronics and tech industry, has ventured into cards and lending earlier. Learning from Apple, a company selling smartphones could launch its first BFSI product as micro-loans for affordable pricing. In time, it could evolve into cards - with discounts for purchasing goods from the same company. Then could come payment products supporting easy payments for its customers. Along the way, there could be branches in the roadmap exploring other types of loans and cards, further expanding business.

References:

- Financing and Credit - Apple

- Apple introduces affordable service of payment for iPhones, iPad customers

Building a bank

Alternately, an organization wanting to become a full-fledged bank, must consider further steps in its strategy:

Banking license. Requirements tend to vary across jurisdictions and geographies, and are usually a very challenging and time-consuming process. Typically, strict and secure infrastructure, strong capital and compliance to regulations are primary themes. Furthermore, the type of license could be targeted towards specific areas in BFSI to ensure maximum returns under the overall goal, while keeping investments to a minimum. E.g., a license to only give credit lines.

Sponsoring balance sheet. A strong capital structure must be available to sponsor the subsequent setup and expansion of the organization as a Bank. The specifics depend on the statutory requirements and risk management policies.

Regulations (again). Banks are held up to stricter scrutinies than Fintech companies. Conduct thorough research to ensure compliance and prevent roadblocks and penalties. This could result in strong organizations for audit, governance and legal areas.

Suit Up example: John Deere Finance

A specialist in agricultural equipment such as tractors and harvesting equipment, John Deere accurately gauged the need for financing of their equipment among their customers. Thus was born John Deere’s financing arm working with lending and payment services.

Reference:

FinTech vs bank

Unlike a bank, a FinTech can afford to offload its regulatory reporting and handling scope to the various banks it may choose to integrate with — allowing quicker and more robust adaptability to varying market headwinds.

On the other hand, a Bank can better approach customers with a variety of products and financial services, which a FinTech will be hard put to justify and sell.

To summarize:

Factor / Strategy |

FinTech Forward |

Building a Bank |

Time to market |

Shorter Weeks to months |

Longer 2 to 5+ years |

Adaptability |

More adaptable to market headwinds and customer needs. |

Less adaptable to market headwinds and customer needs. |

Product portfolio |

Niche areas, typically one or two specific themes |

Broader offering a wide range of products and services |

Costs |

Cheaper Building a fintech product could cost from $50,000 onwards. |

Costlier: Mandatory capital requirements can be $15–25 million. |

Regulatory oversight |

Less stringent, since the regulatory risks can be offloaded to the sponsoring banks. |

More stringent. Penalties and reputation risks can be major drivers. |

Tactical considerations

Irrespective of the choice of strategy, there are overlapping tactical considerations, as follows:

Platform as a Product

Crucially, product managers and leadership must ensure that the products and their features designed for sale are abstracted into the correct platform capabilities. This ensures that the platform as a whole can easily adapt to new products, geographies and participants in the value chains — including and not limited to banks, fintechs and other vendors.

For example, a company building technology solutions for loans including personal loans, education loans and home loans must abstract the relevant product features that are common across these product lines and establish a set of platform capabilities that are easy to parameterize for scale and make addition of new products easy. This long-term thinking saves time and costs as and when more banking-products are added.

Minimum viable product (MVP)

The importance of good product thinking and management cannot be underestimated. Ensure that feedback loops are kept short, income streams are left-shifted and milestones are as frequent as possible.

A good MVP roadmap would typically have:

Short feedback loops

Earn income at the earliest while spending on building further features

For more, please read Avoid the pitfalls of the pseudo-mvp.

For example: a company aiming to go-live with business loans, personal loans and home loans would consider building the set of features for personal loans first since they form a subset of the other loan products. Thus, starting to earn income in parallel with building the remaining features for the other product lines.

Grow with your customer base

Use qualitative and data-driven customer insights to identify and fulfill their evolving financial needs. Grow your customer’s pie to get a bigger slice.

Typical questions the company could ask itself include:

Do I have an existing relationship with the customer through sale of products or services? If yes, how does the customer finance that sale? Can I make it affordable through loans?

Are the customers in need of managing their wealth through their business? If yes, can I provide wealth management services?

Are the customers businesses that make transactions in bulk? If yes, can I offer them payment services?

Build vs. buy

At each stage of the envisioned value chain, the company must consider the possibilities of either building from ground up or buying the appropriate products, services or even other fintech companies. Considerations of risk and control must be weighed against time to market and costs. A bank could quickly go to market by purchasing an existing platform, and then using the revenue to build and replace components over time to make customization easier.

The company’s strategy to go with “Tech Up” or “Suit Up” for BFSI growth hinges on its goals and resources. This guide has outlined the two main paths forward.

Carefully consider your strengths, opportunities and long term vision before making the critical choice. Further business models must be considered within either of the main paths. E.g., a FinTech player could be an aggregator, service provider, product vendor, advisor and so on.

By leveraging the tactical considerations outlined here, you can navigate your path forward with efficiency and effectiveness, for sustained growth.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.