Banks confront new customer demands, and the question: When to create or collaborate?

The exploding popularity of neobanks shows many consumers now trust digital institutions to handle their transactions and savings.1 One recent study found around three-quarters of Australians now do most of their banking on a smartphone or computer, and that one in four have switched or are considering switching to a neobank.2

How Australians are banking in 2020 (Source: Mozo)

How Australians are banking in 2020 (Source: Mozo)

Embracing the approaches that enable more personalised, ubiquitous banking is a complex process for any bank’s senior leadership. Perhaps the first, and most important, decision to consider when confronted with a new customer demand or opportunity is whether to respond with a solution that’s developed in-house, or to collaborate with an external fintech partner.

The difficulties of DIY

At larger financial institutions, there may be a bias towards the ‘build-it-yourself’ route. After all, they have sizeable existing customer bases, historic reputations, links with regulators and more financial and human resources to draw on. But while those factors count, the current landscape also calls for specialist capabilities and a degree of nimbleness that might be difficult for established players to nurture.

In fact, size and legacy systems can act as hindrances when trying to understand customer needs at a micro level, and then creating and delivering a niche product to the market quickly enough. Fintechs, on the other hand, are uniquely placed to provide granularity due to their narrower focus. Being digitally native and less encumbered by legacy architecture and procedures, they are more likely to have the flexibility to design features and apps that address emerging demands - fast.

A financial institution’s C-suite must carefully weigh up all the angles of taking the ‘DIY’ route. Can they commit the resources to maintain frictionless operations and guarantee quality of service? Would the internal team be equipped to collect insights and data from customers to refine the product during its life cycle? If there’s already a similar offering on the market, is the bank really in a position to bring something better to the table? A negative answer to any of these questions is a strong indication collaboration may be the better choice.

Forming a symbiotic relationship

More banks are likely to team up with fintechs in the future for a few reasons. For one, realistically no one institution can anticipate and address every shift in customer demands alone. What’s more, it’s increasingly clear that bank-fintech partnerships have significant benefits for both sides.

Australia is home to more than 800 fintech companies, showcasing the dynamism and breadth of the sector.3 Thanks in part to the regulatory sandbox allowing eligible fintechs to pilot certain products or services without a licence,4 banks already have a compelling roster of potential partners to choose from.

While banks gain from fintechs’ speed, agility and focus, working with a bank gives fintechs the chance to tap into the commercial, regulatory and risk management expertise of an established institution, as well as the ability to engage a far larger customer segment without the expensive burden of outreach and onboarding. There’s also clear potential for fintechs to draw on banks’ deep pools of transactional and behavioural data to develop new products and services, especially as the rise of open banking makes such data more available and accessible.

All this means a bank shouldn’t see turning to a solution created by a fintech partner as a loss or capitulation, but an opportunity to forge a relationship that can lead to innovations or ways to monetise data that were never previously anticipated.

Making the most of this opportunity will for many banks require a change of mindset. Rather than a one-time concession or quick investment, collaboration should be seen as a long-term strategy. Instead of simply buying up or bolting on fintech capabilities, banks need to learn to let go and ‘outsource’ innovation, giving fintech partners freer rein to embed solutions in the bank’s suite of services and experiment in meeting customer needs, so both parties can reap the rewards.

Due diligence is of course important, and a bank’s risk and compliance, security, technology and product teams will need to band together to draft a roadmap for any potential collaboration, including validation of a fintech’s credentials and services. At the same time, banks need to recognise what fintechs are bringing to the table and approach these processes in a spirit of openness and confidence.

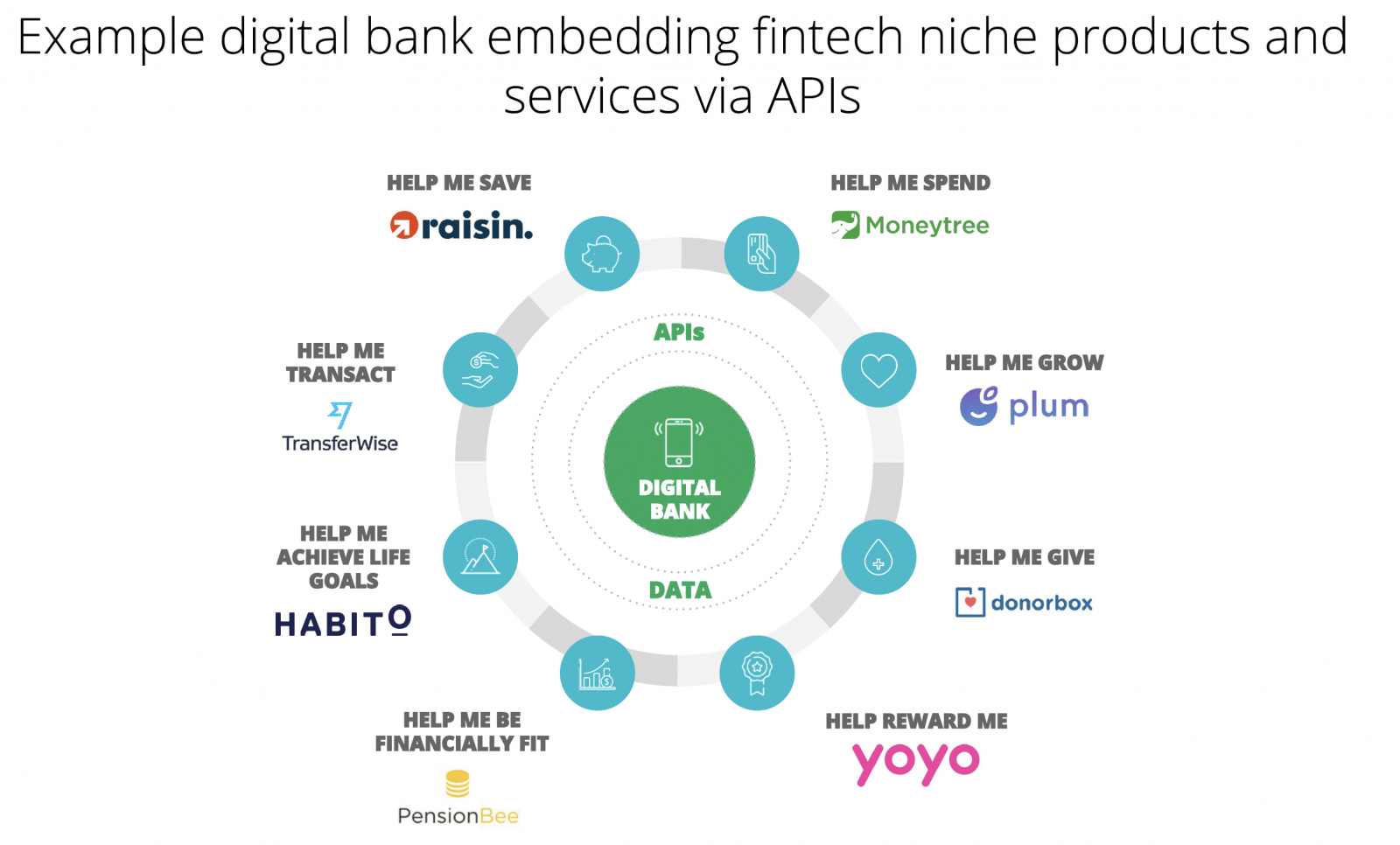

The most effective foundation for an embedded service strategy is a versatile application program interface (API)-based platform that opens certain parts of the bank to the fintechs it chooses to work with. This allows the bank to create a standardised and controlled environment for fintechs to plug their capabilities into, and test and enhance new services, without concerns about the impact on other aspects of a bank’s operations.

Streamlining the technology aspects of collaboration eases the vetting and onboarding process for would-be partners, setting a tone of trust from the beginning. By enhancing banks’ ability to connect, customise and experiment with fintechs at speed and scale, these platforms will underpin the development of entire marketplaces of services to address customer needs, creating new revenue streams for both banks and fintechs in the process. When banks embed, they can build ecosystems - and in the coming weeks we’ll explore in detail the technologies that make this possible.

1. See e.g. https://www.theguardian.com/australia-news/2019/sep/22/neobank-you-might-like-digital-apps-disrupt-australian-habits; https://dynamicbusiness.com.au/topics/news/neobank-growth-in-aus-a-little-terrifying.html

2. https://mozo.com.au/neobanks/articles/neobank-2020-report-digital-banking-in-a-new-decade

3. https://fintechaustralia.org.au/learn/

4. https://asic.gov.au/for-business/innovation-hub/fintech-regulatory-sandbox/

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.

How Australians are banking in 2020 (Source: Mozo)

How Australians are banking in 2020 (Source: Mozo)