The Future of Investment Management: Automated and Human

Wealth, asset and investment management firms are experiencing record results. In 2013, assets under management grew to a record $68.7 trillion, while operating margins grew 39%. Things couldn’t be brighter for the industry.

But as we all know, current performance is not indicative of future results.

Customer churn across the industry is rising. More ominously, most wirehouses have been unsuccessful at winning net-new investors, particularly millennials. Those impressive financial results are clearly more a function of rising markets than they are of organic growth.

New investors are clearly drawn to automated investing services that offer a fundamentally different experience. A growing percentage of all investors are focusing their investments in low-cost passive index funds. In 2014, active funds experienced $98 billion in outflows, while passive market funds attracted over $166 billion in new investment. Investors, both existing and new, clearly favor broad market exposure over stock picking.

Does this represent a secular shift in investing patterns, or is this just a trend that will die when the next bear market returns? How will a digitally native generation choose to interact with human financial advisors?

Most traditional wirehouses clearly assume that once millennials’ lives become more complex and their financial needs become more comprehensive, they will shift to a full-service firm and have their money managed by a financial advisor. These firms are so confident that the future will resemble the past, that they actively discourage their financial advisors from taking on clients with a net worth below $250k.

This is a losing strategy. Here’s why.

The Future of Personal Finance

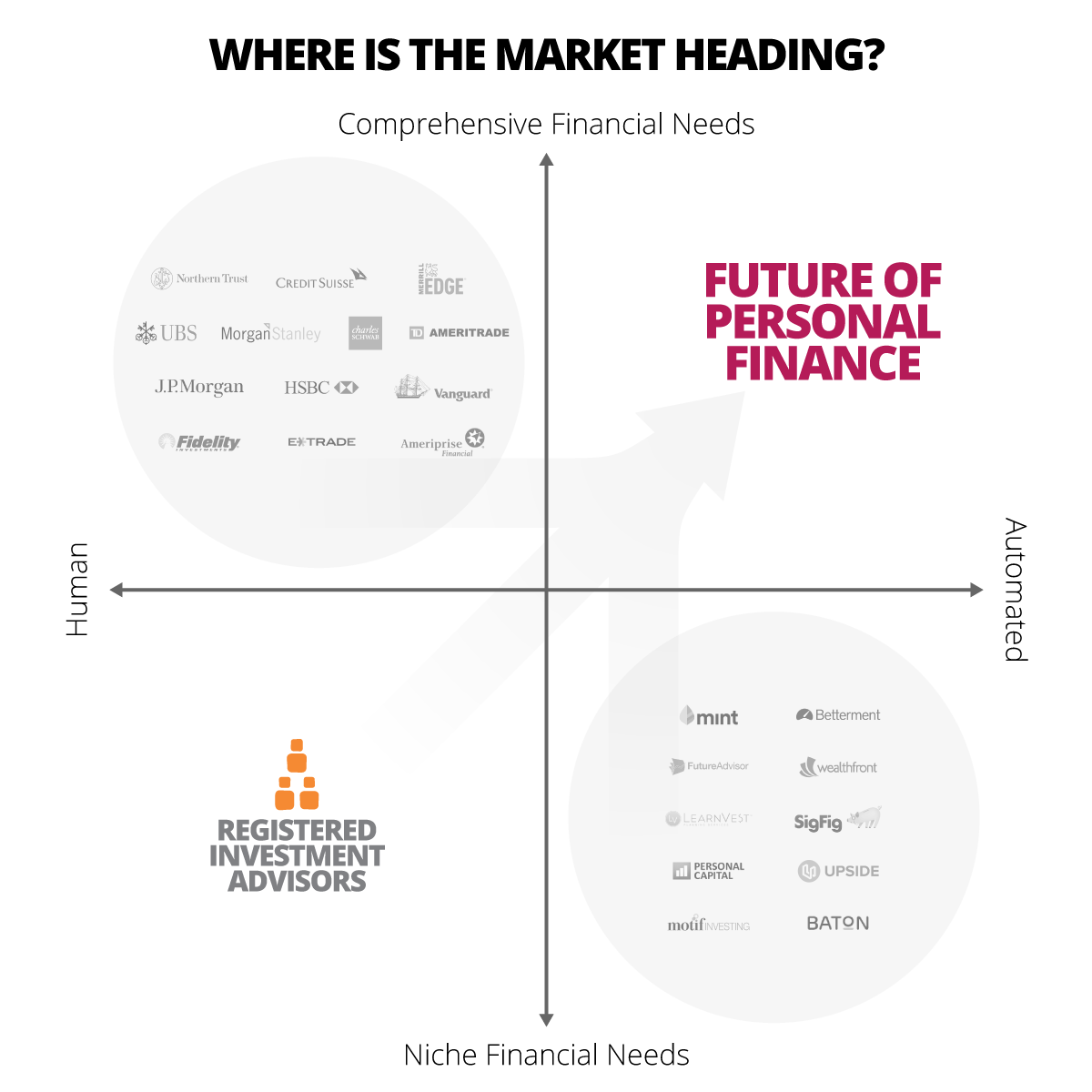

Fintech disruptors are doing a fantastic job of building delightful, highly relevant automated investing services. But these offerings are still fairly niche, catering to the simple need for market exposure.

These products have tremendous potential to bring in a broader base of investors. Who wouldn’t value the ability to consume both emergent and well-established financial products with delightful experiences? Contrast that with today, when most investors endure onerous, time-consuming, and sometimes slimy methods to purchase complex financial services.

More nimble self-directed brokerage and asset management firms have already initiated experimentation with new models such as Schwab Intelligent Portfolios and Vanguard Personal Advisor. These seem to be steps in the right direction.

But fintech disruptors like Betterment, Wealthfront, and Motif are releasing new products and capabilities rapidly, with the hope of beating the giants to the big new opportunity—a comprehensive portfolio of automated financial services.

Let’s imagine what that future might look like. What if Betterment began to offer access to alternative investments, life insurance and annuities? What if Wealthfront began to offer a simple method to think through inheritance and estate planning? What if Motif offered a peer-to-peer lending product catering to higher net worth individuals? More striking, what if Apple or Google chooses to offer financial products to complement their other emerging financial services such as payments?

Any one of these moves could quickly undermine the core value proposition that bulge-bracket firms now offer to their customers.

Incumbent banks and brokerages still have a core competitive advantage with their armies of trusted human advisors, and they will retain trust. But as a broader base of investors veer towards passive investing vehicles, incumbents will be forced to follow them.

They too will need to offer a more comprehensive suite of financial products that can be consumed through digital channels. But if they have pivoted their approach and adapted sufficiently, their people will be the bridge between self-direction and human guidance that so many investors value.

Four Tips For the Future

No business model has a right to exist. If current models cannot propel future growth, what must slow-moving legacy firms with utility technology organizations do differently?

- Automate more financial products

Incumbent firms already have many of the necessary licenses and regulatory infrastructure to support the automation of offerings such as life insurance, secured loans and annuities. Develop automated investment services that cover a broader range of complex financial needs. This could also offer an opportunity to experiment with new models, such as peer-to-peer lending and social networks of investors.

- Focus the human touch where it matters most

The greatest value a human financial advisor offers is focusing a client’s attention on what matters, and on a bigger picture. Clients are prone to loss aversion bias, and during market swings, they may make choices that are highly damaging to their long term financial health. Human advisors can effectively address that client behavior better than any automated process or a call center representative. Humans can also more effectively initiate contact with clients around life events and other changes that impact goals; this prompting can be kicked off, and amplified by the digital platform.

- Leverage new automated services to scale for new investors

Incumbent firms must develop products that allow them to offer relevant services to younger, lower net worth individuals that will be the next generation of high net worth clients. The days of investors migrating to old-school advisors in middle age will come to a screeching halt. Those investors are already drawn to automated, passive, low cost vehicles. Each company will need to offer an automated solution that mimics this core value proposition while offering a more sophisticated, curated offering.

- Have the client’s best interests at heart

The days of salespeople as brokers are numbered. Demand that all advisors and brokers adhere to the fiduciary standard. Few customers trust that decisions made by a broker are in their best interests. Companies perceived as exploitative—with opaque fees and murky conflicts of interests—will face a tremendous trust gap when a generation of digital natives who expect transparent access to information controls most of the wealth. Act in the customer’s best interest, not just in marketing, but in practice.

Disruption is the New Normal

Algorithms and automated services are here to stay. These recommendations have many implications:

- Financial advisors will earn much less per client, but automation will enable each advisor to manage a book much larger than the current 150 client limit.

- Pricing and fee transparency will lead to much more fungible services, where counseling and trust will earn higher fees, not choosing investment products that conform to internal interests.

- Human conversations will not be replaced by automation; next generation digital platforms will serve to amplify them, and increase their value.

- Automated consumption of more financial products will inevitably lead to greater internal consolidation; internal P&L and business line conflicts will be broken by threat of extinction.

If financial firms want to win over the next generation of investors, we have one message: embrace disruption. Focus on why fintech upstarts are valuable to future customers, and co-opt that value proposition through the lens of your heritage and people. Build better, more comprehensive digital products that make your people more valuable to your clients. Current performance won’t predict future results, but it can drive you and your company to a stronger future.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.