In this two-part article, we’re going to explore how to deliver more business value from your enterprise cloud operations. We’ll introduce ideas around so-called FinOps and take a deep dive into how this can maximize cloud returns.

Getting more from cloud

Today, the majority of enterprises use cloud computing. And usage is increasing. Between 2020 and 2021, more than 60% of organizations moved more workloads to the cloud. But while many still believe in the vision they’ve been sold — that of cost-effective, resilient and scalable tech — some still struggle to articulate the value they’re getting.

In this context, we’re going to explore the ideas of FinOps and look at practical steps to ensure your organization derives more value from its cloud investment.

So what is FinOps? According to the FinOps Foundation’s definition, it is a “financial management discipline and cultural practice that enables organizations to get maximum business value by helping engineering, finance, technology and business teams to collaborate on data-driven spending decisions.”

But a definition only gets you so far. How can you introduce FinOps effectively in your enterprise? And more importantly, how can you show that this will deliver business value?

In Part Two, we'll describe the six principles to help.

Establish a vision

The first step in achieving the goals of cost effective cloud operations is to establish a clear vision for what you want to achieve. This shouldn’t be a generic statement repurposed from your cloud provider. This is as core to your business as your product vision. Aligning your cloud vision with your product vision will dictate how you generate the right outcomes.

For instance, your organization’s FinOps vision could be along the lines of: ensure that the growth in cloud costs are directly proportional to the business value it generates and all levels of the organization are aware of why the costs occur and the invariably nascent wastage is addressed within one quarter, by close well defined collaboration between Finance, Technology and Product teams.

It can be tempting to think of FinOps’ goal solely in terms of dollar savings. We believe it’s better to think in terms of optimizing investments and maximizing the returns on those investments. If your goal is merely to cut costs, it is highly unlikely that a modern cloud implementation is what you would need to achieve that goal.

By focusing on why you’re investing and thinking about how to maximize returns — rather than on the minutiae of how you’ll do it — you can come up with measure of solution quality to guide your decisions. Outcomes remove dogma from the debate and this is where the vision becomes an absolute prerequisite.

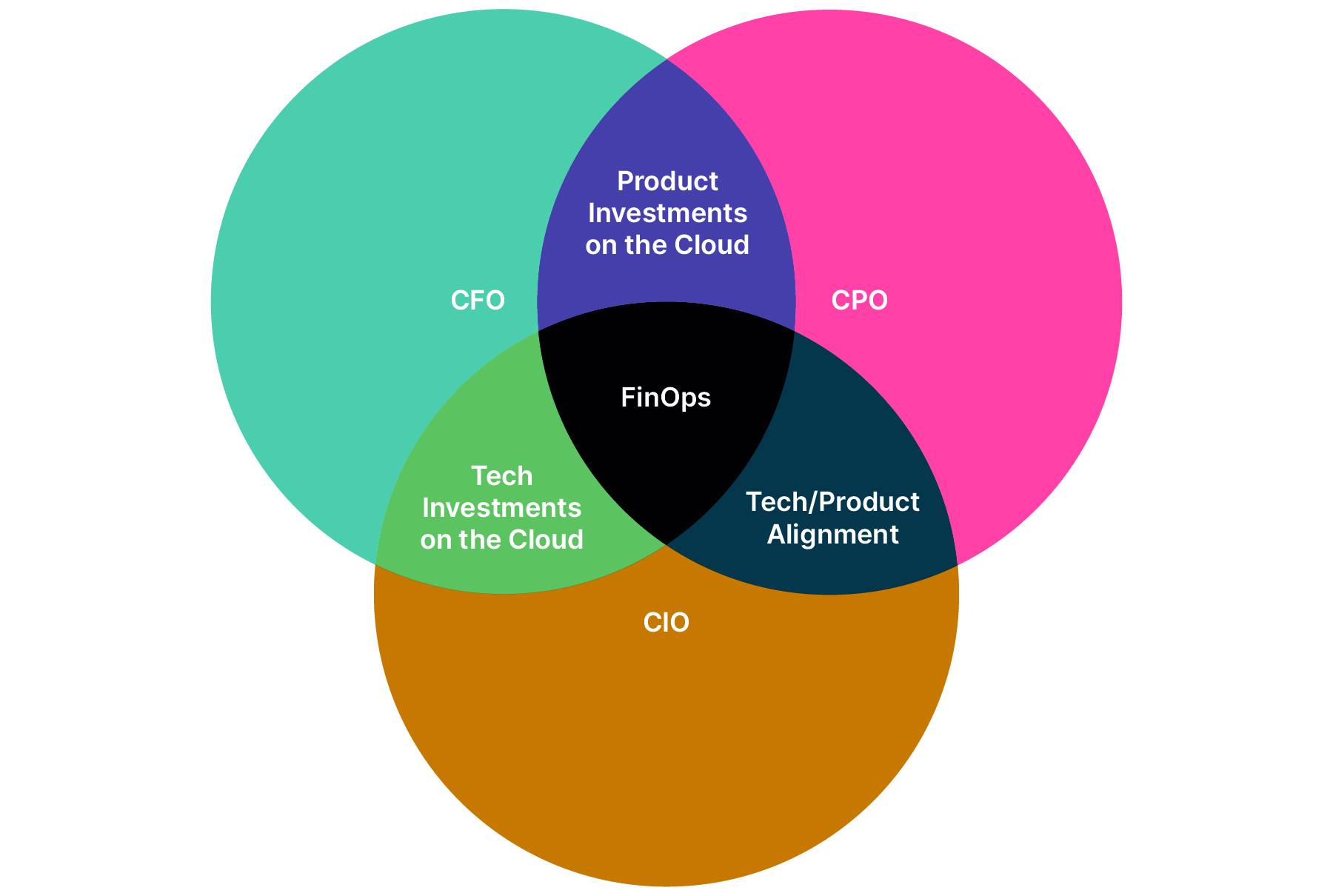

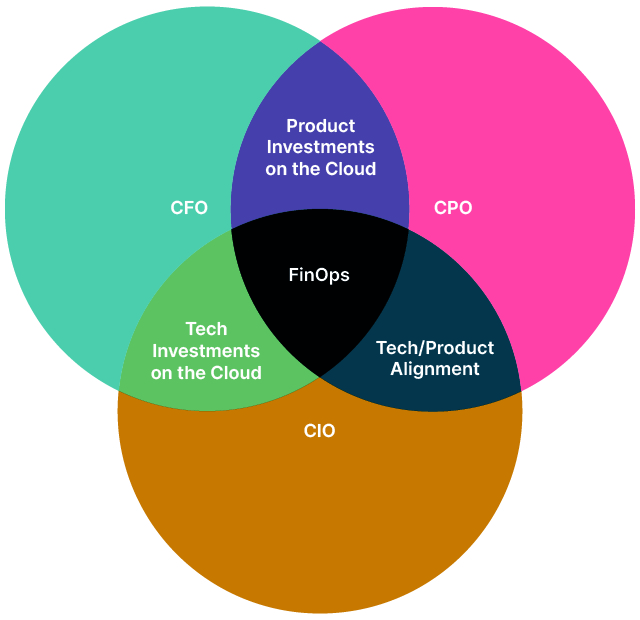

Discover and map the stakeholders

We all know the familiar pattern of tech funding: the CFO controls the purse strings; enterprise IT spend is allocated to individual departments and rolls up to the CFO. When this happens, the decisions to govern and manage the spend — and the controls that are imposed based on it — are ultimately driven by the overall allocated budgets. And this results in a zero-sum game, where CIOs and other department heads are forced to horse trade over allocations; the results aren’t always optimal for business growth. Rarely do you see a mindset of product leadership owning this budget and justifying the need for a specific investment. These challenges are even more pronounced when operating in a cloud environment.

Recommended Organizational Ownership of FinOps

Investment in on-premise infrastructure have been traditionally managed around corporate budget cycles of one to three years — depending on contract lengths and acquisition methodologies.

Public cloud infrastructure is fundamentally an on-demand, instant delivery, API-driven system. It gives organizations the ability to manage capacity and demand as needed. But fluctuating demand isn’t matched by existing funding, planning or ROI processes in most enterprises. To drive value from cloud investments, that must change: to more accurately engage, at the finance level, in more rapid feedback loops and review cycles.

Public cloud has inherently a different billing model from past on-premise infrastructure and software purchasing models. But models exist to help capitalize investments and manage a balance between capital investments and operational expenses. This requires us to go back to fundamental principles and design with those in mind.

We believe cloud investment is more effective when there’s joint ownership between your chief product officer , CFO and your chief information officer. Under such arrangements, each leader can provide empowered proxies to represent themselves and be responsible for making the collaborative decisions aligned with the vision within the larger cloud governance framework to engage directly in these much shorter product analysis and investment analysis cycles.

Other stakeholders include individual product engineering teams, technical capability platform engineering teams, existing architectural and operational governance bodies from your organization.You may also have external stakeholders, such as your public cloud providers and other third party managed service vendors.

Make observability a first-class concern

Much of the literature around FinOps focuses on core principles and the need to optimize results. We’ll address this in depth in Part Two of this piece. Suffice to say, it helps to embrace platform thinking and the importance of observability.

Maximizing ROI and optimizing spend depend on knowledge of how your applications and systems are operating. If your applications suffer from poor instrumentation and your systems don’t integrate with your financial billing data, you’ll inevitably find it hard to optimize cloud spending. That is why your observability platform is critical.

Through Investing in high-grade observability practices across all systems — for instance, using data-driven decision making, open instrumentation, simple actionable visualization, all driven by observability driven design — will deliver superior results when it comes to system monitoring and performance for customers.

By combining analytics from your cloud vendor’s billing and usage data, these measures give financial and technical teams the information needed to make informed choices about cloud investments. Thus, they can decide when it makes sense to leverage shared infrastructure or to move from vendor-managed to internally managed infrastructure; they are empowered to manage financial commitments and can do so while making technical choices over what will be best for their products.

Structure your FinOps organization

At Thoughtworks, we frequently come back to Conway’s Law when thinking about team structures. According to Conway’s Law: organizations, who design systems, are constrained to produce designs which are copies of the communication structures of these organizations.

We see evidence of that at clients, in their first attempt to use public cloud infrastructure: they end up with an account structure that mimics the organization structure of the operations and team and the security implementations will be largely reflective of the current on-prem environment. But these are generally orthogonal to the best practices that allow for the delivery of instant business value that drives cloud adoption.

Organizations that have existing ticket or workflow-based processes for security or financial governance fail to deliver value when those processes are used to govern the public cloud. The tendency for organizations is to start treating the public cloud services as a utility as opposed to a product. And as a result, they fail to link consumption to outcomes. To get the most value from the public cloud at the lowest cost, some organization change will need to occur.

So whether you’re a startup, scale-up or established enterprise, we believe that you’ll benefit from introducing the principles of FinOps at the same time that you embark on your cloud journey: assigned responsibility to, someone who is technically adept has an understanding of your services. The investment in this person can be the catalyst for your long-term success. They’ll constantly keep an eye open for the pitfalls and opportunities to drive the six core principles continuously.

Map the FinOps lifecycle with dependencies

We sometimes see clients — who are ostensibly modern digital organizations — that shy away from governance over fears that this word will somehow impact their agility, that governance will impede their ability to move fast and curtail innovation. We don’t think this is true. Effective governance helps organizations succeed.

In the context of cloud economics, governance is a critical piece with both upstream and downstream dependencies (see below). For example, an API-based approach to say security or cost control, ensures that you don’t need manual controls and checks, which are instead based on a foundation of controls that can be tweaked as needed.

Governance Dependencies in Cloud Economics

Upstream dependencies are the prerequisites needed to ensure proper governance, which necessarily must include:

Resource tagging. This is often mentioned when it comes to managing cloud costs. Our approaches from a product/domain aligned perspective will make sure that you are able to understand and automate the resource tagging using your existing infrastructure tracking and tooling

Solid IaC principles. A robust infrastructure as code (IaC) framework will ensure that new resources provisioned is always on track

Tying back into the existing governance bodies. It’s important that you don’t create new governance bodies to do cloud governance, instead tie back into your existing architectural and operational governance bodies

Those upstream activities create the foundation for the following downstream outcomes:

Tag compliance. Compliance with your resource tagging has to be automatically made visible, not just through cloud reporting tools but potentially, via the observability dashboard. This will give you a holistic picture of any compliance matters

Architectural alignment. Policies established by providers require architectural decisions during the design phase of both your infrastructure backbone and your product design. Public cloud offerings are notorious for allowing the users to establish one set of policies and adopt a completely different set of random practices that violate these policies based on these decisions

Governance. Significant elements of governance can be achieved by the often misused term of lightweight governance. Lightweight governance, in this context, doesn’t mean the governance is barely enforced, but the fact that by automating the core of the governance policies your governance bodies have a headstart in making the right decisions. Once you let a service slide through intentionally or otherwise, it is very hard to bring it back to compliance as your product owners wouldn’t want such activities to impact their velocity. This is why the use of governance has to have the right decisions built upfront and your CPO will eventually be accountable for that.

Make value-driven decisions

One of the most often overlooked aspects of FinOps are models that enable enterprises to predict what value they’ll get from cloud investments.

We think this is best achieved by simulating specific scenarios based on the cloud investments you plan. For instance:

Developer productivity. How much payback do you have, from a pure dollar value, for taking on additional opex costs?

Operational cost savings. This looks at issues such as the cost of an incident and the lifecycle costs of a set of incidents over time, based on investing in specific cloud services.

Security profiles. What are the hidden costs of security decisions you would have to make when choosing a specific set of security services implementations?

The purpose of these value models are not to tell you whether you should invest in something or not, but rather to enable you to prioritize for the business as you invest in newer cloud-native services and continue to scale your application services both horizontally and vertically.

In Part Two, we’ll take a deeper dive into platform thinking, and explore how this can help embed FinOps practices successfully into your enterprise.