Financial Services 2025: Eight Strategic Forces that are Transforming the Industry

What happens to today’s banks if interests rates remain at historical lows, global economic growth remains tepid, and new channels emerge that productively allocate capital better, faster and cheaper?

This is part two in a four-part series. Read Chapter 1 - How to Grow in the Challenging Years Ahead and Chapter 3 - 3 Core Principles to Unlock Growth

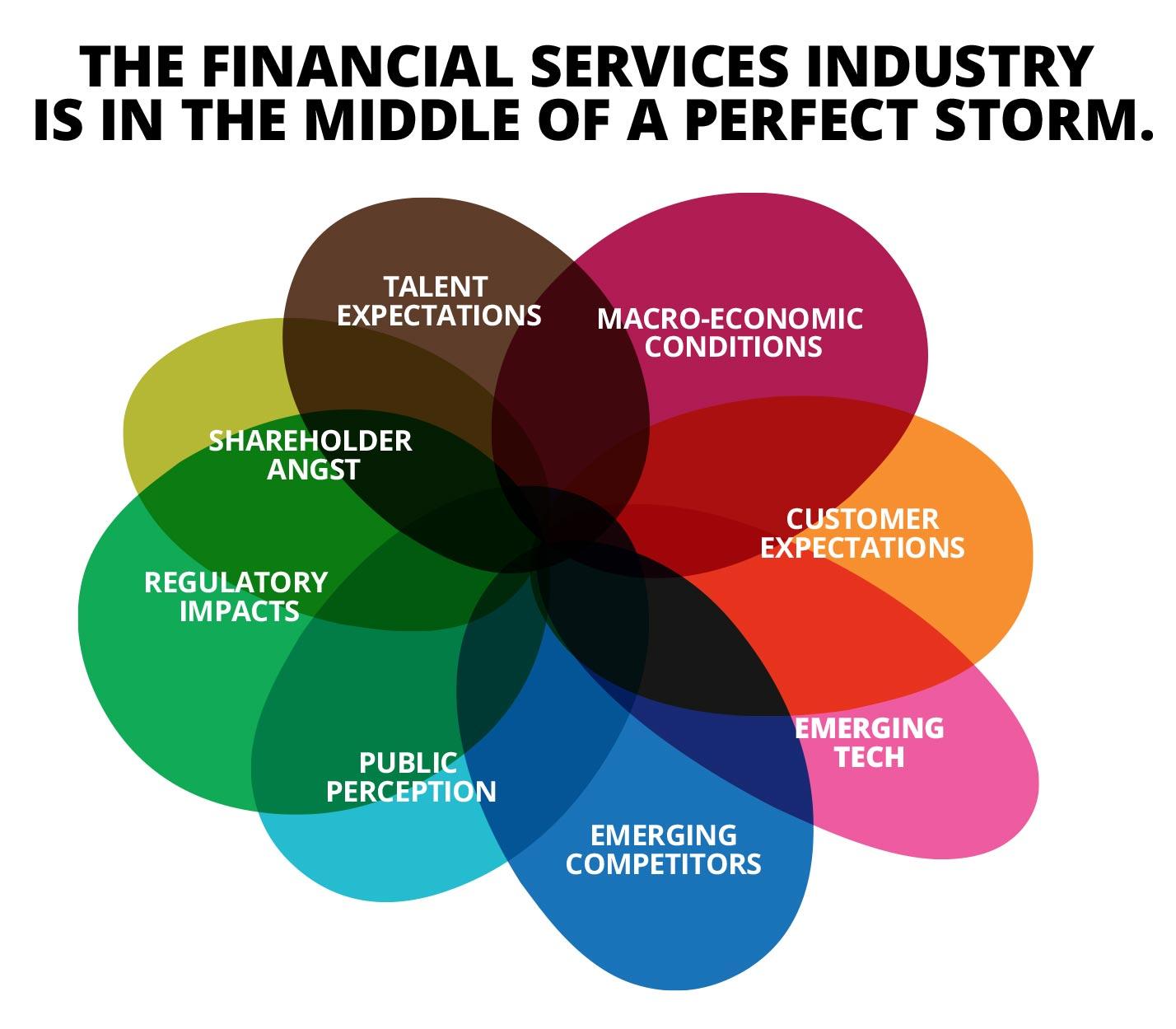

The Financial Services industry is in the middle of a perfect storm, caused by eight distinct yet interconnected strategic forces. This combination of internal and external forces are compelling executives to invest scarce resources in multiple, contradictory directions. This is widening the trust gap between the industry and its customers, as pressures to retain current margins leveraging existing models comes at the expense of transparency and customer alignment.

Executives are well aware of the compounding effect of these disparate but interdependent forces. They know that these forces demand a holistic response. However, all too often we witness a reversion to silos, which drives more internal focus, localized optimization, and jargon-filled communication. This in turn reinforces the trust gap.

We believe that the key to unlocking organic growth is to tackle the trust gap head on, and to place the customer at the center of all decisions - across front, middle and back offices. Executives must adopt and invest in a clear customer-led strategy. They must harness these strategic forces to create new value, instead of falling victim to them.

This article provides a brief overview of these eight strategic forces, and asks for your thoughts on each. We finish with the implications of these forces on the future of the investment management business. We will discuss our recommendations and the path forward in the final articles of this series.

Customer Expectations

Investors across wealth spectrum, across genders and across generations are increasingly choosing banks, advisors, and products that deliver on transparency, clarity and alignment. This trend will accelerate as market volatility and low interest rates put pressure on investor returns.

Regulatory Impacts

The growing patchwork of regulations already impose a steep complexity tax on financial services firms. Pending regulations such as the fiduciary standard rule, and the broader shift towards pan-national regulatory regimes will result in substantial shifts in the investment management landscape. Automation will enable deeper regulatory focus on removing all conflicts of interests.

Public Perception

The public still largely distrusts the investment management industry, and thinks the “game is rigged”. As a result, millennials will continue to fragment their financial relationships, leading to the loss of loyalty and stickiness. This will continue to have a self-reinforcing effect on changing customer expectations and heightened regulatory scrutiny.

Emerging Competitors

Robo-advisors are just canaries in the coal mine for what is to come. Large technology giants like Amazon and Google have made investments in the financial services ecosystem, testing the waters for possible new forays. Google is one of the largest investors in FinTech. Given their current public perception as more trustworthy customer advocates, they may quickly take AUM and lending share without facing the same regulatory scrutiny as banks.

Macroeconomic Conditions

The incredible volatility in the markets, perpetually low interest rates, falling consumption in China, and the lack of a clear global growth engine will add to instability that is making predictable, steady growth impossible. Compounding this effect is the impact of increasing wealth concentration from growing income inequality, and global climate change on both developed and developing economies. The growing fungibility of capital will make local markets vulnerable to global economic dynamics.

Talent Expectations

The best talent does not want to work for ‘slow, steady, bloated, and political.’ They want an environment where they can do their best work, and make a valuable impact. They seek mission-driven opportunities instead of “ladders to climb.” They will not patientially climb a traditional career ladder. Traditional investment management companies that retain their current operational and organizational structures will not attract the next generation of high potential job hunters.

Emerging Technologies

Beyond the widely heralded distributed ledgers and Internet of Things, new technology vectors are emerging that will fundamentally alter many of the core elements of the banking value chain. Quantum computing will eliminate encryption-based security, and allow for extreme automation of investment management. New big data based solutions will automate the efficient allocation of capital across multiple asset classes and make complete transparency and traceability as the new normal.

Shareholder Angst

Shareholders of these companies are well aware of these incredibly turbulent forces, and the lack of a clear vision to rethink the core industry value proposition. As valuation multiples industry-wide continue to shrink, and as margin erodes from new competitive pressures, shareholder angst will continue to accelerate. The stock price collapses affecting European banking giants today await portend the effect on the entire financial sector.

What do you think?

We crafted a set of customer-led hypotheses to help executives reimagine responses to these forces. These hypotheses are based on our experience working with multiple global financial services organizations across the globe and market research. We would like to hear your opinions about the validity of each of these hypotheses. Here are the hypotheses and the results of a recent poll from readers of this article.

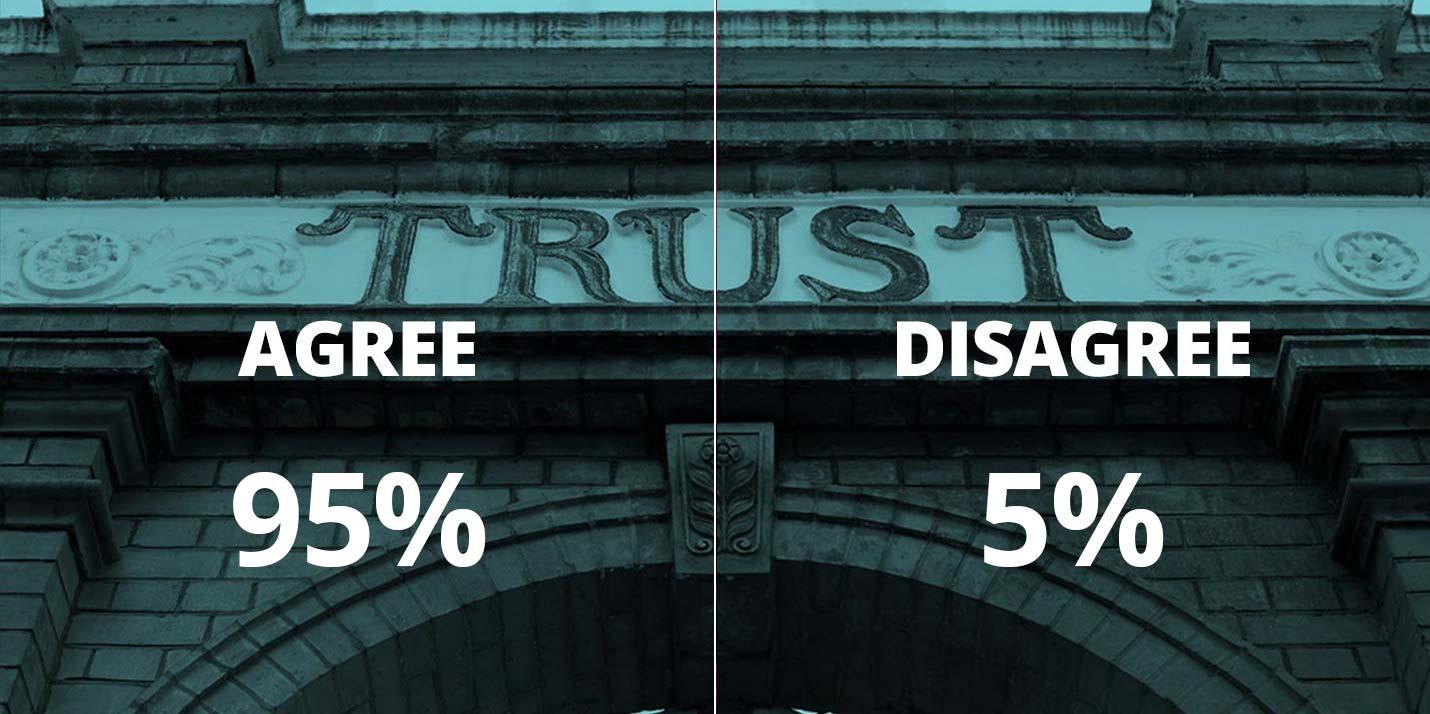

Pricing opacity will end. Customer-led companies must deliver on transparency (in distribution) & trust through the entire value chain. While simple to consider, this may lead to substantial changes across multiple functional areas and redefine existing business models. For example, revenue sharing arrangements between asset managers and brokerage firms must end.

Customer-led companies will attract Millennials and future generations who align with mission-driven companies that offer them a greater purpose than just making money. These firms treat future talent like they treat their customers.

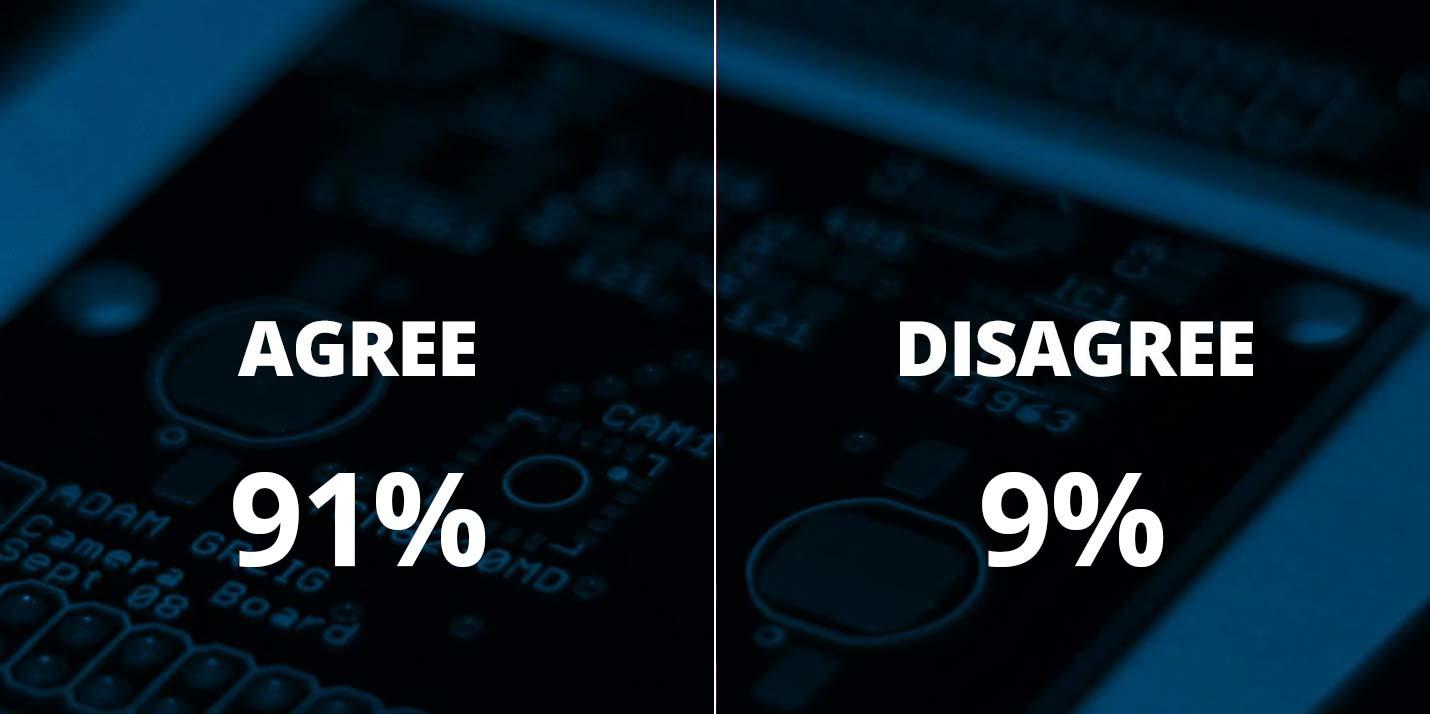

Customer-led companies must decrease operational complexity through automation, and solve for reducing compliance risk by becoming more transparent in fees, incentives and performance .

While macro-economic forces may act as a headwind, customer-led companies can beat internally focused competitors and achieve organic growth by responding to new opportunities and threats more quickly.

Customer-led companies that offer transparent, clear, easily understood investment relationships and solutions will win trust from investors that are concerned about "getting taken advantage of".

Customer-led companies can strengthen their existing brand with new value propositions powered by technology. For example, they can make Investing much less daunting, and more engaging through better use of data and personalization.

Shareholders reward customer-led companies across industries because their greater customer loyalty, and higher customer net promoter scores lead to greater pricing power and sustainable profitability.

Implications for the Industry

The implications of sticking with business as usual while addressing these complex forces are profound.

ETF scale, radical automation and consolidation across the entire value stream will lead to exponential efficiency, ultimately squeezing fees and expenses close to zero. This will be true across retail and institutional channels.

Asset management will continue to follow the current “winner take all” pattern that is dominant in Silicon Valley, in which the top players take a growing percentage of market share and profits, while niche companies fight for share and profits with edge offerings. Firms in the middle will be squeezed from the top due to lack of scale, and from the bottom due to their need for higher fees and broader product mix.

Traditional advice and broker/dealer firms will face lower revenues per customer, higher customer attrition, and lower organic growth if market returns remain low for a long time. As Bill McNabb, CEO of Vanguard recently stated, if investor returns are 4% or less per year over the next decade, asset managers and advisors will be hard pressed to explain the value of taking 25-50% of those returns in fees and commissions.

Ancillary revenue streams will be threatened without organic growth in AUM. Interest income on cash sweeps and loan volume currently comprise between 20-25% of revenues. That income stream may disappear if customers see little value in the core investment management offerings.

Technology companies who offer financial services are going to exploit the lower barriers to entry and highly advanced software engineering practices to automate much of the existing industry value chain, and disintermediate entire classes of companies (and services) winning new business and gaining critical mindshare.

The days of opaque fees, hidden commissions and other ‘invisible’ costs are numbered.

Both existing retail and institutional buyers will put increasing pressure on traditional companies and their advisors to justify high fees and commissions and clarify on behind-the-curtain complexity. New customers will demand greater alignment of purpose with investments and fee structures.

We see many ambitious business leaders across the world devoting significant time and money to build new operating models that enable their customers to do business on their own terms, where they want to and how they want to. Tech giants like Google and Intel as well as traditional financial corporations are seriously investing in new businesses to disrupt financial services. They have reframed the problem into an opportunity.

How can financial services leaders respond, and unlock new organic growth?

Organizational inertia is being driven by a set of turbulent strategic forces.

Next week: Unlock The CXO’s Dilemma: 3 Secret Weapons for Growth

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.