Banks are Reinventing Customer Engagement

Organisational agility has been a hot topic for a long time. In the South African context, financial institutions have made enormous strides in improving banking, in spite of a very strictly governed environment, taking into consideration compliance with the regulatory requirements imposed by the South African Reserve Bank.

How did these organizations achieve organisational agility? For the South African major banks, achieving organisational agility in light of market influences has proven to be challenging. These organisations have, with great difficulty, tried to reinvent customer engagement, whilst trying to ensure that they comply and avoid regulatory sanctions.

Let’s examine the complexities surrounding these financial organisations by looking at the following:

- The problem at an organisational level

- Examples of how regulations impact financial institutions

- The challenges these organizations face with engaging customers

- Ideas for banks to get on the right path

Banks have constantly been wrestling with the responsibility of translating ideas into new sources of economic value. Primarily because adaptability has not been their key focus, for decades these organisations have favoured inflexibility in return of efficiency. However, it’s important to understand that responsiveness is an important consideration since organisational markets are driven by opportunities within that market segment, these opportunities have definitive lifecycles. Let’s understand what challenges these organisations face with innovating towards new market opportunities.

Understanding the Problem

For the last five years financial institutions have constantly been trying to succeed at becoming more innovative. With the strive towards innovation, these organisations face numerous challenges within highly regulated and complex environments. To put this into perspective, let’s look at a definition for innovation.

- Innovation is “the successful development, implementation and use of new or structurally improved products, processes, services or organisational forms” (Hartley, 2006).

In order to be innovative financial organisation are faced with the challenge of transforming their business into “success”. The challenge these organizations face is that their business processes are deeply rooted in business models and organisational hierarchy and structures that are non-responsive or non-adaptive. Oblivious to some aspiring organisational leaders, most of the technologies within these organisations were built to support traditional rigid business processes, which are not easily adaptive to change and almost no-longer fit for purpose. As a result innovation is stifled by examples of the following:

- Inflexibility (Rigid systems that are difficult and cumbersome to maintain, or changed)

- Speed (Skilled resources to deliver business value quickly and effectively.)

- Variability (Market turbulence and undirected focus on business value)

- Uncertainty (Where organisation are not mature to deal with uncertainty)

With the continuous strive towards innovation, banks are going the extra mile in trying to satisfy customers and continually seek creative ways of engaging with their customers. All innovation attempts are made on the basis of being able to accommodate such initiatives through technology primarily. Let’s look at an example of how innovation gets stifled, and how the inability of these organisation to adapt, affected its income statement.

Stifling Innovation

On 1 March 2011, financial organisations were required to register for compliance to new legislation called (FICA). According to this legislation financial institutions were required to keep track of the customer information as well as the details around the nature of the financial transactions that took place. More detail on the requirements is discussed here.

Over a period of three years, these organisations could not change their business processes and systems to comply with these requirements. Their internal systems and business processes was not adaptive enough to comply with the requirements of the SARB (South African Reserve Bank), as a result these institutions were fined millions for non compliance to the FICA legislation.

So the question is how do organisations strive and still innovate in a highly regulated environment? How should these organisations remain competitive and still comply with regulatory requirements?

Let’s consider a progressive timeline:

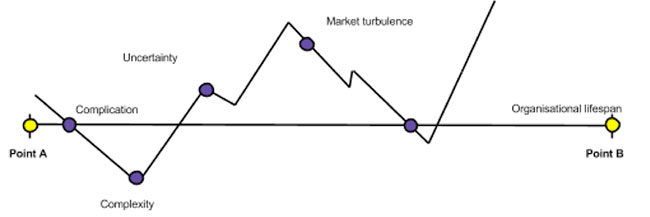

In the above example, the movement of an organisation from point A(Non-compliance) to B(compliance), can be considered a measure of two factors:

- How far the organisation has moved?

- With what ease did the organisation move between points?

This representation of movement of an organisation is a simplified expression of an organization's ability to deliver or succeed, often understood as the organization's agility or adaptiveness. Therefore the competitive movement of these financial organisations from point A to point B, is an indication of the magnitude and rate of change over time. The slow responses due to rigid business processes, and technology combined with invariability ultimately affected the speed at which these organisations could comply with the necessary regulation.

A good question to ask at the point is, why? What could cause these organisations to not comply with the FICA regulation?

The answer to that is that there are two functions that impacts these financial organisations on a daily basis, marketing and innovation (Drucker, 1985 ). IT on the other hand becomes the enabler to support these business functions. All of this is done in an attempt to retain customer and grow their businesses through marketing, but customer engagement has proven to be a major challenge to these organisation.

Challenge with Engaging Customers

These financial organisations and many others employ various channels to engage and attract customers through different channels such as :

- Social media (Organisation wants to become a talking point),

- Websites (Organisation want to offer self service portals),

- Contact centres (Organisations wants to lower telephonic waiting queues),

- Integrated voice response (IVR) (Organisation wants to improve self services, to lower human intervention),

- Loyalty programs (Organisations wants to retain customers) and

- Mobile solutions (Organisations wants to be reachable to mobile customers)

Customer engagement on different service levels in the financial sector has become highly idiosyncratic. With innovation at the forefront, these organisations are attempting to tailor their services to individual needs of customers, examples of these are private banking, premium banking and prestige banking clients and customised interest rates. Where the primary goal for these financial institutions is to tailor their services to specific customer requirements in order to satisfy and retain customers.

In this instance the higher the level of service customisation required for each individual customers or groups of customers the more difficulty the organisation will face with replicating and routinizing its solutions and process. Due to such challenges, these organisation who chose efficiency over adaptiveness will face difficulty with applying new business models considering that a lot of their current business processes and models operate on traditional non-adaptive systems (Lowendahl, 1997). So in an environment where strict regulatory compliance exists and tireless attempts to engage and retain customers, it requires the realisation that change in the organisational perspective is required. But what change is required, where do you start ?

Getting on the Right Path

The reliance on IT and more specifically software development, to accommodate innovation and constant business change, has pushed these financial organisation to streamline their support functions, such as IT, accounting and other functions in order to deliver better customer value and achieve greater levels of customer retention and satisfaction.

In this instance the Agile movement in software development is seen as the silver bullet to enable primary support functions of a business to become successful. However, in order to achieve true organisational agility is to understand that software delivery and organisational adaptability are inseparable. A holistic roadmap is required in order to achieve success.

In some organisations, IT attempts to become agile on behalf of the organisation, and there is the broader perception that IT only has to adopt agile practices in order to bring about change. The problem with this is that traditional business processes stifles responsiveness and flexibility due to the governance processes, that are strongly rooted in the organisational compliance and policies. This inflexibility, which was initially instilled through traditional and inflexible frameworks of the business. Examples of such obstacles are:

- Commercial to be signed-off by business before software delivery can start.

- To many business stakeholder to make decisions effectively.

- Change control processes that prevent quick delivery.

- Procurement of software tools and vendor compliance.

These are just a few examples of what happens, when IT adopts agile practices and governance and compliance enforced by traditional frameworks stifles the agile delivery of innovative initiatives. It also paints a practical example of how financial institutions are finalised whilst trying to keep the customers happy and comply with the regulations of its environment.

More Reading:

- Mark Collin, Disruption in Retail Banking [Insights]

- Drucker, P. F., 1985. Management: Tasks,Responsibilities, Practices. First ed. New York: Truman Talley Books.

- Lee, H.L. & Whang, S. 2001. E-business and supply chain integration. Stanford Global Supply Chain Management Forum. November.

- Lee H.L. 2004. The triple-A supply chain. Harvard Business Review, 83:102-112. October.

- Sull, D. 2009, The only way is up. Business Strategy Review, 20: 64–69. doi: 10.1111/j.1467-8616.2009.00617.x

- Thomas, D.M., 2013. Business Skills for E Commerce. First ed. CTI Group

- Thomas, D.M., 2010. Investigating the Information Technology Factors that Contribute to Supply Chain Management.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.