Most of the world’s central banks are exploring standardized digital currencies - a trend commercial banks are watching with a mix of excitement and trepidation. For banks the prospect of central bank digital currencies (CBDCs) raises multiple questions; how can they be monetized, how to avoid disintermediation, and what kind of additional technology investments might they require? Now, some of the answers are becoming clearer.

There are both “push” and “pull” factors behind the surge in CBDC plans. The “push” is that major corporations such as PayPal have already rolled out digital currencies, amid the wider shift to digital forms of payment. As the Bank of England points out, the growth of such ‘private money’ means access to and use of central bank money could decline, with the monetary system becoming fragmented and unstable as a result.

On the pull side, CBDCs offer the prospect of programmable currencies that will enable entirely new types of transactions. As well as keeping central banks at the forefront of monetary innovation, such currencies could streamline payments, supporting business activity and economic growth, and boosting financial inclusion among unbanked groups.

Mapping the impact

Of the 130 central banks looking at CBDCs, 64 are in the advanced stage of rollout, pilot or development. Not surprisingly, this is forcing commercial banks to consider their consequences.

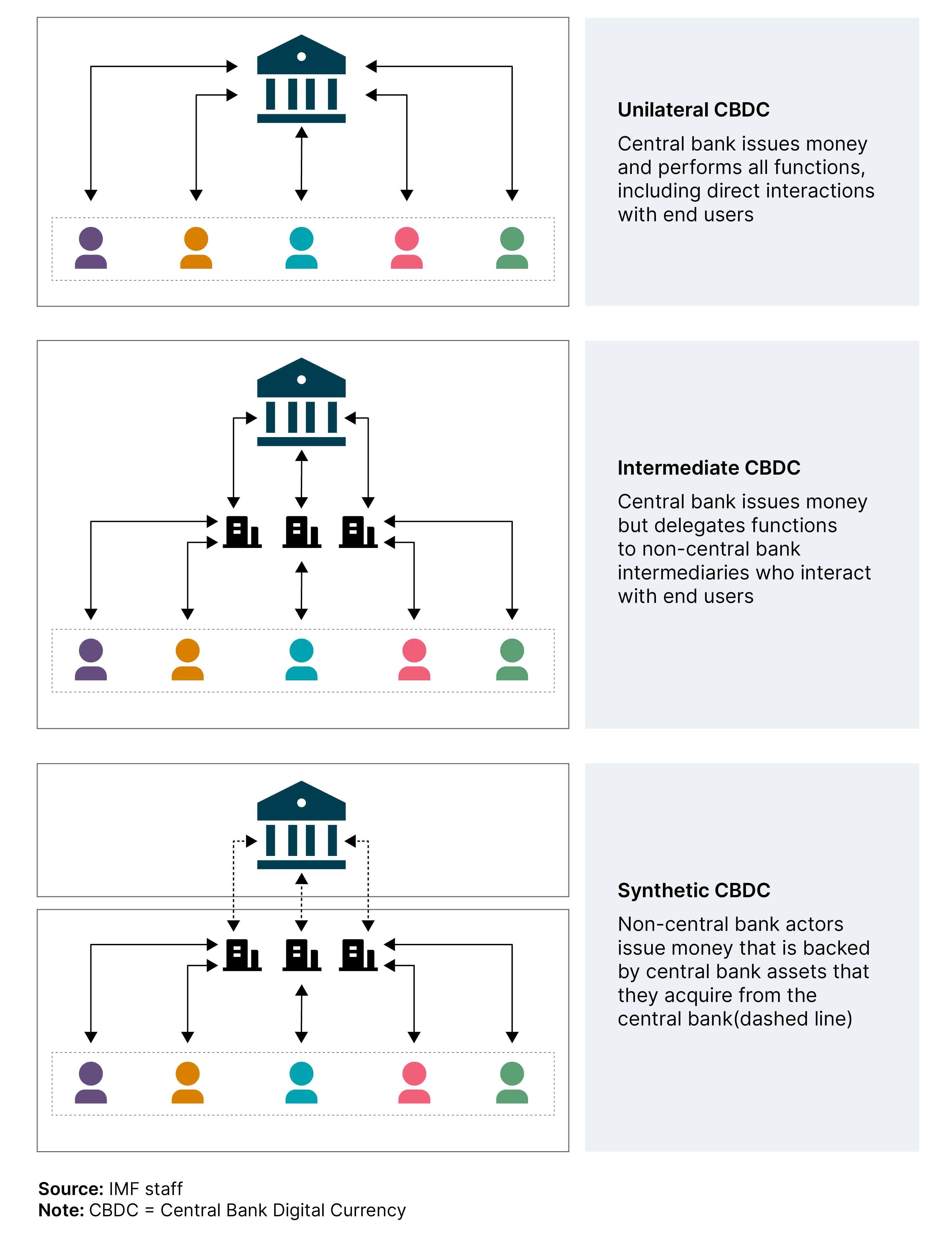

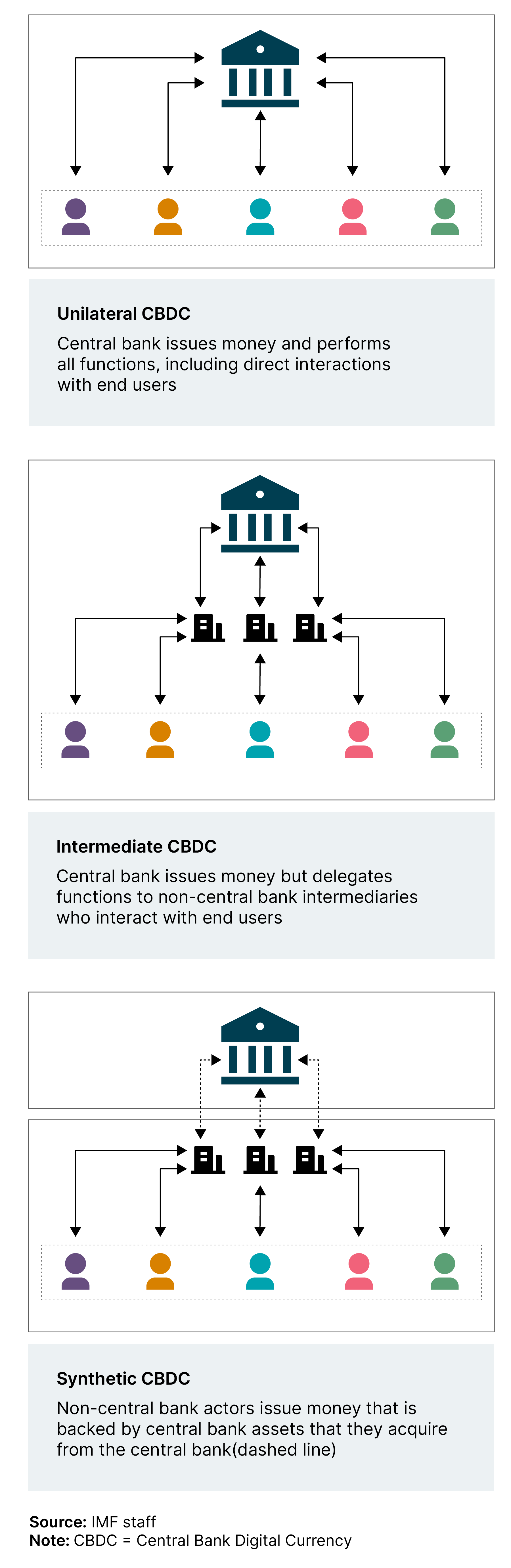

Among the longstanding concerns is that CBDCs are a direct claim on a central bank that, in theory, may not require a commercial bank as an intermediary. Germany’s central Bundesbank has modeled the risks of CBDCs shrinking the commercial bank sector, leading to higher lending costs and even “runs” from commercial bank deposits into CBDCs.

At Thoughtworks, we have run our own agent-based modeling and simulations to understand the implications of CBDCs for commercial banks. There are several possible permutations of how CBDCs might work in practice, including one in which a central bank essentially cannibalizes the work of commercial banks. But in our view, what the International Monetary Fund (IMF) calls an “Intermediated CBDC” is more likely to emerge as the norm, except perhaps in countries with underdeveloped banking sectors where unilateral CBDCs may better serve the cause of financial inclusion.

Stability is the watchword for central banks, and this means they are taking a cautious approach to CBDCs. As the IMF noted in a 2023 working paper, most countries are considering a "two-tier" CBDC model, where central banks issue CBDC to commercial banks which in turn distribute them to consumers. Indeed, the US Federal Reserve is prohibited by law from offering bank accounts to individuals.

Spark the extraordinary power of modern digital payments

When it comes to payments, your customers want simple, secure and seamless. An experience that sparks delight. Discover how we can help you deliver the extraordinary.

How banks can benefit

Another key conclusion from our modeling, and our extensive experience in both traditional financial services and the digital asset space, is that CBDCs are likely to coexist with other forms of payment. This will be key not only to commercial banks’ continued relevance, but also for the emergence of new revenue and growth opportunities. For example:

Tokenizing and de-tokenizing

The Bank of England has said that even if it rolls out a CBDC, it will guarantee the continued availability of physical cash for as long as people want it. Interoperability with other forms of money will likely remain the province of commercial banks - provided they have the necessary technological infrastructure to perform this function.

Trade settlement

The idea of a single matrix that captures all the world’s financial assets into interconnected, unified ledgers is a tantalizing one, but such a ‘Finternet’ remains conceptual. In reality, managing the fragmentation of many different systems of tokenization, and ensuring that trades can be settled transparently at fair value, is a job most likely to fall to commercial banks. The Society for Worldwide Interbank Financial Telecommunications (SWIFT), the main messaging system for international bank payments, has been running sandbox experiments with central and commercial banks to foster this kind of interoperability.

Identity and compliance

It will remain necessary to verify the identities of all parties to a transaction if CBDCs are not to be misused by criminal elements. Many central banks are sensitive to citizens’ privacy concerns and therefore reluctant to do this themselves.

Industry sources such as Goldman Sachs have noted the likely compromise is for central banks to task their commercial counterparts with the role of monitoring customers and transactions. The longstanding expertise of commercial banks in terms of compliance and know your customer (KYC) protocols could therefore form another part of their business case around CBDCs.

Cross-border transfers

For commercial banks with an international footprint, CBDCs have the potential to completely transform their role. If CBDCs are to be a successful motor of global trade, they need to be transferable across national borders. International banks that invest in the new ledgers, messaging and settlement systems needed to create this new world of cross-border payments are likely to be in a position to monetize them.

This extends to remittance flows, which are important to many fast-growing emerging markets. Some of the countries exploring CBDCs are doing so to explore more efficient ways of repatriating money from their diaspora. Simplifying correspondent banking transaction chains could create cost savings not only for individuals, but also for the commercial banks involved, with the latter retaining a critical role in countering money laundering and terrorist finance while ensuring interoperability between different systems and the smooth flow of transactions.

Enhanced services

Innovation fostered by CBDCs will allow commercial banks to offer more targeted, and premium, services. For example, with a CBDC, programmable money can be issued as vouchers to be spent on a particular good or service, such as healthcare or crop seeds. Or, payment for a product purchased online could be programmed to complete only when the product has been delivered to the purchaser. The Reserve Bank of Australia (RBA) points out that CBDCs also reduce settlement risk, particularly for large transactions such as property and financial assets. Commercial banks that pioneer new mechanisms will be able to offer them as an option for clients, sometimes at higher price points.

Cost savings and efficiency

Banks can expect significant efficiency savings from the use of CBDCs, particularly in settlement processes but also more generally across the functions listed above. This will serve to bolster margins in payments businesses and potentially expand volumes by offering customers new and highly convenient payment channels.

Strategy and execution

The impact of CBDCs on financial institutions in any given market will depend heavily on the exact model a particular central bank adopts. But overall, we’d argue they should be viewed as a positive development for commercial banks. As Goldman Sachs points out, central banks have an incentive to prevent disintermediation, given banks’ essential role in financial stability and lending. The IMF notes that all current CBDC pilot programs have in-built incentives for consumers to keep deposits with commercial banks, to avoid undermining their business models.

All that said, CBDCs require action on the part of commercial banks, to build new business models and avoid being displaced by digitally native new entrants. The first step is a careful evaluation of the technological resources and tools that will be needed to support the transition to these new forms of payment, and to pursue the new revenue streams they will make possible.

We advise commercial banks to take steps now to assess the use cases and risks around CBDCs relevant to their business. It’s important to explain a coherent CBDC strategy to shareholders and other key stakeholders, and to ensure this strategy is backed with the flexible technology platforms and processes needed to participate fully in a fast-changing payments ecosystem.

Our track record of working with traditional banks, and in the rollout of digital assets and blockchain-based solutions, uniquely positions us to advise banks on the opportunities that will emerge as and when – not if – CBDCs move into the mainstream.