In banking terms, Georgia’s TBC might be considered young, being less than 30 years old. But in digital terms, it’s pretty ancient. Customer expectations have upended, thanks to digitization — the entire finance sector has had to rethink their business models. Digitization is key to being competitive in this new environment, but becoming a digital company is no trivial task. This is an era defined by speed of innovation rather than efficiency, flipping decades’ of perceived wisdom on its head.

TBC knew they had to change their operating model, and wanted to become more agile. But it faced significant challenges with time-to-market in critical product areas. And that raised the specter of losing valuable market share to competitors and Fintech startups.

In this interview, Inga Kelauradze, who leads agile transformation at TBC, and Heiti Hoffschmidt, an advisory consultant at Thoughtworks, reflect on the challenges TBC encountered, and how product-aligned teams enabled them to overcome transformation roadblocks.

Question: What changes are you currently seeing in the banking industry?

Inga Kelauradze: Over the last years, banks had to face a critical challenge: becoming digital businesses. Customer demand for seamless digital experiences forces constant evolution. Software drives this shift, and as banks we try to differentiate ourselves with unique digital solutions. Time-to-market is critical for the delivery of new features. Also, customers are more willing to change who they bank with, so staying competitive in terms of user experience and product offerings is critical. Finally, there are far more players in the market. In addition to the traditional banks, Fintechs and financial service providers offer new solutions that increase the competition.

Heiti Hoffschmidt: As software-first companies, these new Fintechs excel in integrating digital innovation seamlessly across their offerings, setting a high bar for traditional banks. In comparison, legacy systems and monolithic architectures often limit traditional banks’ ability to innovate at the pace demanded by the market.

To tackle this challenge, many banks are setting up digital transformation programs, trying to bridge the gap between traditional operations and agile, customer-centric models that will define the future.

Q: How did that translate to challenges for TBC Bank specifically?

Inga: Like many others, we realized that we need to put technology at the heart of our company. However, the limiting factor to becoming a digital company is actually not software itself, but the organizational structure and how well it supports the development of new products that customers love. So in 2019, we started our agile transformation journey and introduced the so-called Spotify operating model. This move aimed to enhance agility and streamline product operations. However, despite initial enthusiasm, we encountered some hurdles along the way.

One of the main challenges came from the high interdependence among our 140 squads. This complexity led to prolonged time-to-market for products spread across various business units, which limited our ability to respond swiftly to market demands. Also, we realized that embracing Agile does not stop with a structural change, it also requires an upgrade of our company culture.

To help us solve these issues, we started our strategic partnership with Thoughtworks in late 2022.

Q: How would you describe the situation at the beginning of your collaboration?

Heiti: It became evident that TBC Bank had made commendable strides in embracing digitization and fostering a culture of learning and innovation. Their vision for a tech-driven future was clear, and they prioritized building the right internal capabilities. However, a key challenge remained: translating strategy into actionable steps.

Inga: Heiti is right, we struggled to connect strategic planning and execution. Despite our vision and commitment to digitization, translating it into actionable steps proved challenging. We struggled to align transformation efforts and drive value creation. All this led to a large number of fragmented initiatives that lacked clear goals, which made it hard to measure progress and identify areas for improvement.

Capacity and accountability were also pain points. We had several conflicting roles that led to a lack of ownership. All this contributed to an excessive amount of work in progress beyond our delivery capacity. That slowed down the overall momentum.

Q: How did you approach this complex situation, what did you focus on?

Heiti: Based on our observations, we formulated three strategic bets:

Improved portfolio management,

a stronger product owner role, and

better alignment of tribes and squads with product domains.

Improving portfolio management includes aspects such as cascading priorities, accountabilities and resource allocations. The idea is to align initiatives and related investments more effectively with strategic objectives and expected business value. We also believe that Product Owners that are truly empowered to drive outcomes and make their own decisions create better products, improve execution and reduce bottlenecks. And finally, product-aligned, decoupled teams allow TBC to streamline processes and reduce dependencies, which creates a more responsive organizational structure overall.

Based on these bets, we created a transformation roadmap designed to enhance TBC Bank's agility.

Inga: Instead of creating a comprehensive plan, we defined a set of core principles that would guide us through the transformation. One example is “Align autonomous teams to products or services”. This captures the idea that the key to an agile and resilient organization is to set up teams around products, and to empower them to take ownership and act autonomously with end-to-end responsibility. A second principle is “Change in increments to enable learning and adaptation”, because we also wanted to apply agile ideas to the transformation itself.

Heiti: This second principle sounds simple and intuitive, but in reality it isn’t. Many organizations like TBC follow a holistic transformation approach, trying to tackle all pain points at once. This is commonly referred to as a “big bang approach”. Unfortunately, for major changes to have a positive impact, many aspects must interlock perfectly all the way from the strategic level to execution. The difficulty of change is usually underestimated and many shortcomings only unfold during the implementation.

Big bang approaches often try to solve this by excessive upfront planning. However, there is a huge number of "unknown unknowns" that we cannot predict.

Imagine the following scenario: You identify the need to become more product-centric and decide to introduce a Product Owner role across the organization. You define the role, you nominate people, and you give them objectives based on your company strategy. What sounds straightforward on paper is pretty complex. What other changes are actually needed to make the new role function? Do we have clear scope boundaries per product? Is the product team setup clearly defined, and what about their interfaces? Suddenly you realize that you have to change way more aspects of your organization. And this assumes that all products work similarly, and all the people behave in the same way.

It is simply unrealistic to run a transformation like this, because there are too many variables involved.

Q: So what did you do differently? How did you try to manage these “unknown unknowns”?

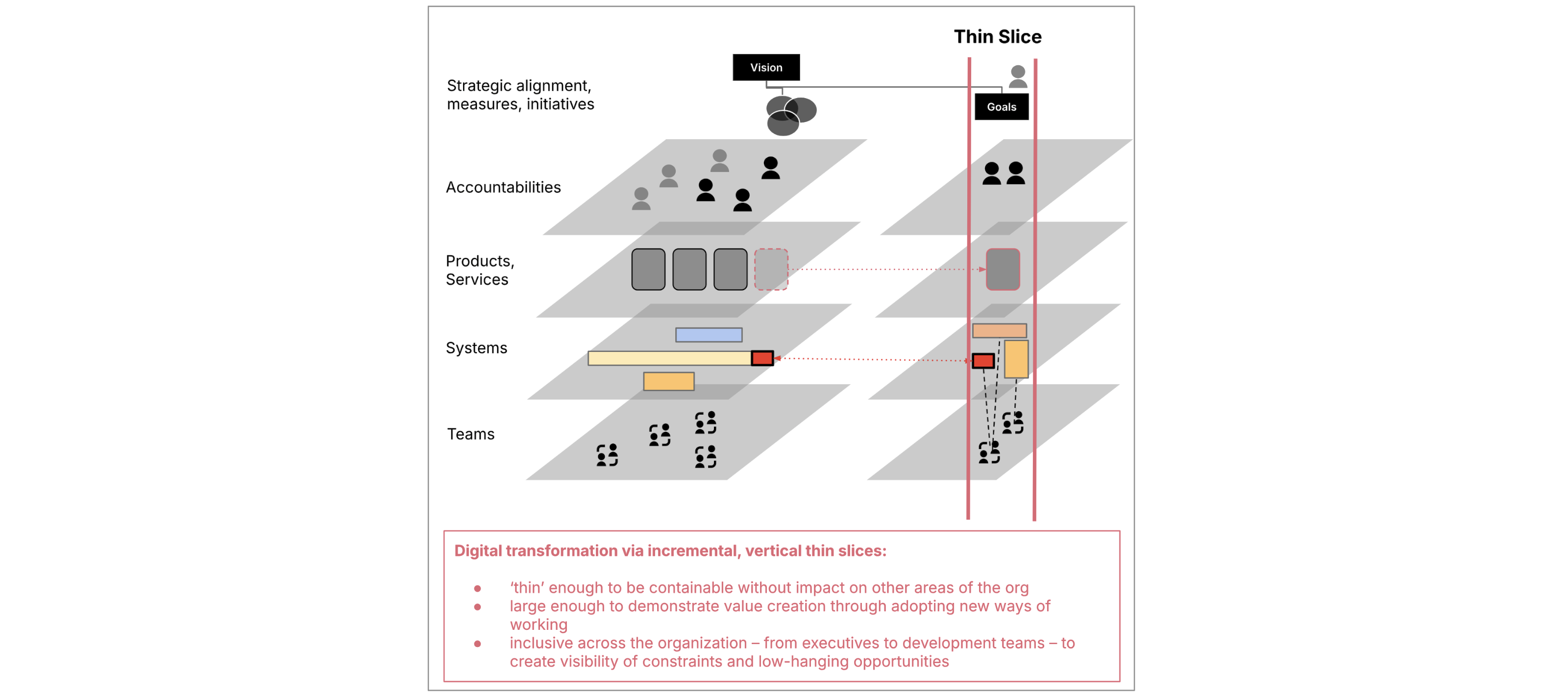

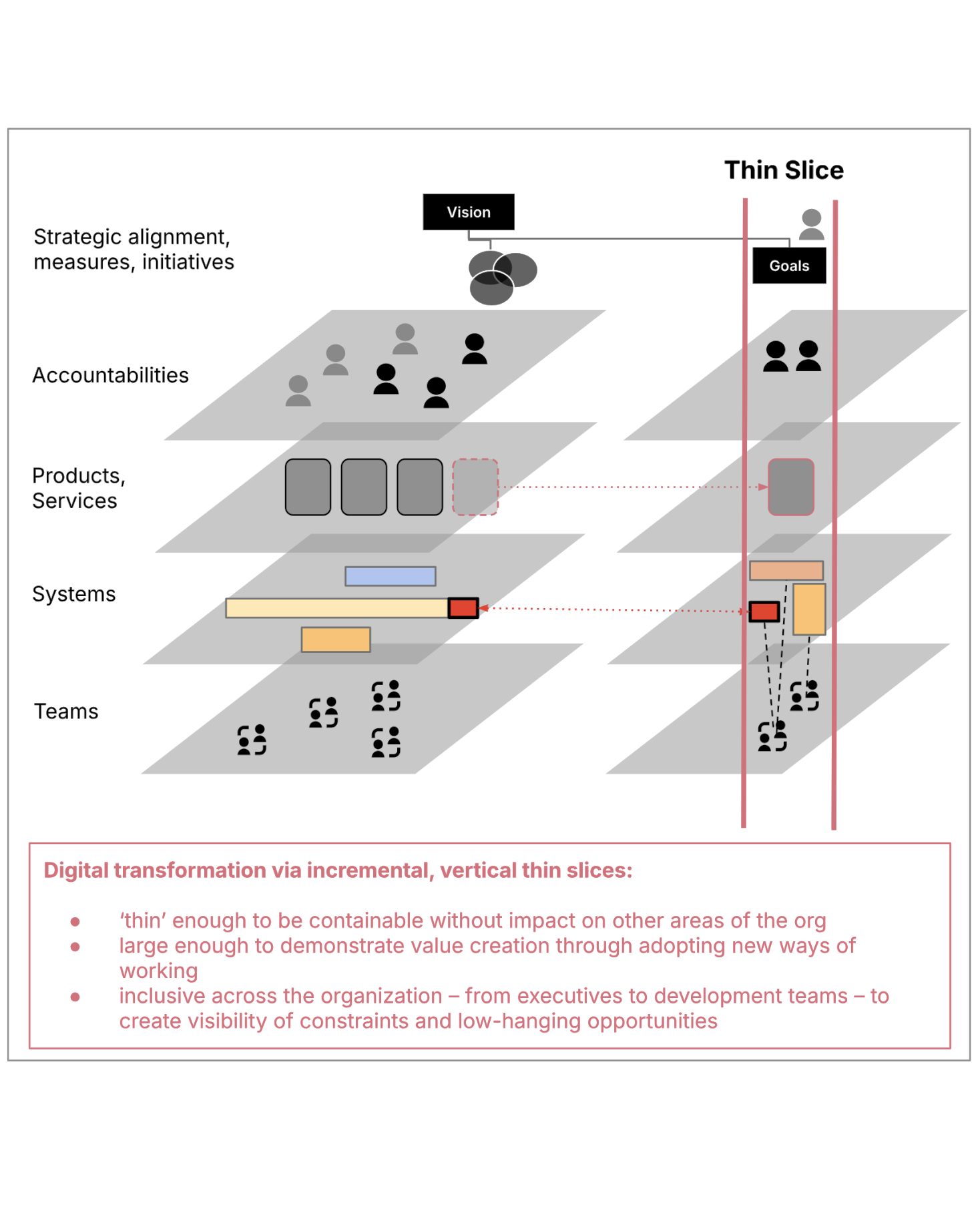

Heiti: While all-out changes have their place in certain scenarios, we usually recommend to start with what we call a "vertical thin slice". A thin slice describes a part of the organization that is self-contained, and vertical means that the slice includes all people, functions and components required from top to bottom. It can be a business unit, a product area or even just a single product. This slice acts as a pilot implementation to test and learn before scaling.

An ideal thin slice focuses on an area that needs urgent improvement, has enough business relevance to show the benefits of the change, but also has a reasonable complexity to increase the likelihood of success for the pilot. During the pilot phase, all changes should be confined to that thin slice. This makes it more manageable for the organization to learn how to deal with the long tail implications of changes. Of course, the result might not feel like a fundamental change, but it is a showcase for the new ways of working.

Inga: For us, this pilot also created a hands-on experience about what it takes to get autonomous teams aligned to real business value. It provided a showcase of the positive impact, so people could get a better idea of what the transformation could look like. And of course, it also uncovered areas that needed further exploration before scaling the change.

Q: Speaking of your experience, how did you apply this in practice?

Inga: The leadership team identified our Subscription product as a great candidate for the pilot.

Earlier in the year a competitor had launched a digital solution and managed to capture substantial market share. To us it was clear that without a focused scope and the autonomy of an end-to-end product team, we would not be able to respond quickly to this competitive threat.

We launched the pilot to integrate cross-functional teams around a single product vision. This approach spans across digital platforms, systems, and operations, in a subscription product managed entirely by a dedicated product team. The Subscription product team is accountable for all facets of product development, from system health to achieving tangible business outcomes in collaboration with business segments.

After only a few months it became clear that the pilot has been a resounding success. It has actually revolutionized how we manage product development with end-to-end ownership in product management. It has allowed us to make strategic decisions with a focus on maintaining product competitiveness and accelerating time-to-market. We also managed to significantly reduce dependencies and streamline our operational efficiency. I think one underestimated reason for this success is that we not only introduced a Product Owner, but paired her with a dedicated Tech Lead who is making technical decisions for the product, and is responsible for the technical integrity.

Heiti: Speaking of success factors, it is important to mention that the Agile Transformation Office (ATO) has played an important role with their hands-on support and enablement. The change management aspects can be easily overlooked, and it is important to plan for this on all levels of the organization.

Q: Where are you now on your transformation journey? What’s next?

Inga: Only six months after the pilot transformation, we overachieved all objectives set for the Subscription team, which also belongs to the teams with the highest employee satisfaction within TBC. So the end-to-end Product Ownership model has proven to be a powerful framework, enabling us to manage our products more effectively and with greater dedication. It underscores the value of cohesive team collaboration and strategic leadership in achieving product health and market competitiveness.

In addition, we just finished our first wave of scale-out transformations, which created a number of additional autonomous product teams for strategic products. This balanced approach between scaling and focus ensures that energy and resources are concentrated, while change-related disruptions in other parts of the organization are minimized. With this in mind, we will continue to transform TBC into a digital-first company.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.