Great Financial Services Companies Deliver Products, Not Projects

This is the second article in a four part series, where the authors share their experiences and insights on ushering technology fueled innovation in incumbent financial services organizations. Here are the first, third and fourth articles in this series.

—Competitive Pressures Drive The Business Case For Modern Application Delivery by Kurt Bittner and Diego Lo Giudice, Forrester, October 2014

Blame Apple: customers expect to be delighted. By placing consumer delight at the center of its growth strategy, it has set new standards for customer engagement.

Today’s customer expects nothing less from their financial management experience. Wealthfront and Betterment are new disruptive forces in the wealth management space. They offer carefully curated, personalized experiences for the next generation of investors.

Customers have flocked to these new services. By the end of 2014, Wealthfront and Betterment were managing $1.7 billion and $1.4 billion in assets, respectively.

This disruption has triggered frantic competition amongst incumbent wealth management firms. At first, it may seem that these well-entrenched firms are uniquely positioned to realize success in a rapidly growing digital investment marketplace.

However, the project first mentality at incumbent firms limits their growth potential to simply converting existing accounts, rather than maturing into a digital first customer experience. Incumbent firms need to adopt a product first mentality, where business and technology collaborate closely to iteratively deliver experiences that customers truly value.

From Project First to Product First

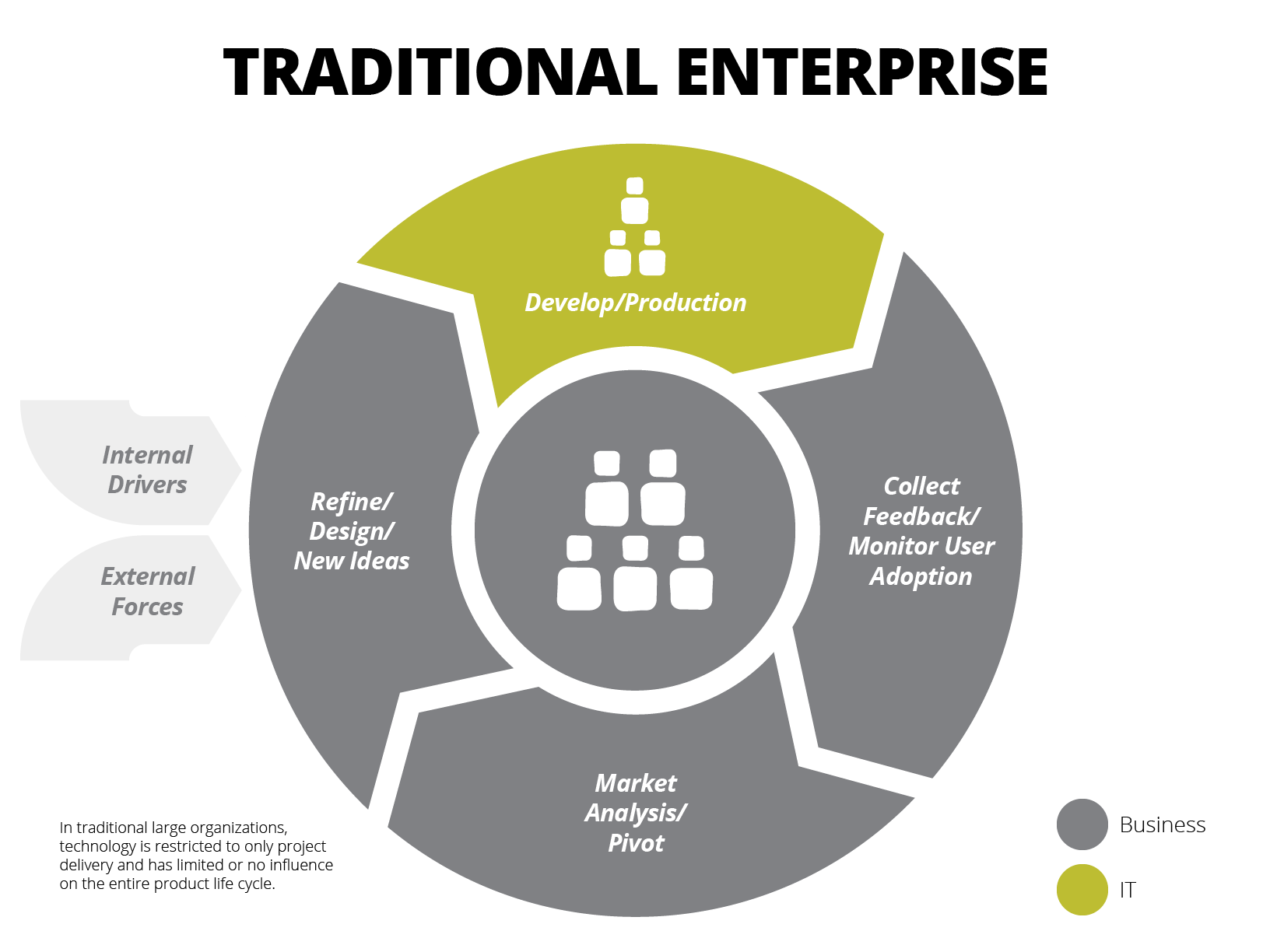

Products have a measurable ROI in terms of customer value, projects don't. Technology leaders in large financial firms are still delivering customer and internal experiences as projects, essentially treating systems of engagement as if they were systems of records.

Efficient processes and practices exist to ensure that projects are completed on time and on budget. Typically, projects are deemed a success within the large firms if they are completed on time and within budget. IT leaders are promoted and fired based on project success or failure, regardless of the impact the software delivers to the bottom line.

By contrast, upstarts are not worried about projects. They build products that will engage customers and create new ecosystems. They focus on continuously investing in products as assets.

Projects have a definite end, while products do not. The life of a product starts when the technologies deployed are used by the intended users and customers. When a project ends, however, traditional technology units in large enterprises lack the opportunity to assess the true value the technology delivers over its lifespan. This highlights the misalignment between internal technology divisions and the true business goals.

Customers do not care if your organization is delivering projects on time and on budget. The only thing that matters to them how they engage with your technology products and services.

Set Up Cross-Functional Product Teams

For success, create and nurture product-centric teams that partner with both customers and business stakeholders, collectively owning the business outcome of the technology they produce.

Technology leaders need to focus on every aspect of the team: people, organizational structure, communication channels, and management models. This thorough approach provides product governance, product management, and product delivery, enabling the entire organization to deliver strategic business value to customers.

Product teams structured in this way own the entire lifecycle of a product, not just one or two projects. Using agile methodologies to iteratively improve the product, customer feedback is incorporated from the very beginning to ensure the product being delivered is the right product for customer needs.

Only a few large financial companies have been able to do this successfully. For Credit Suisse, user research showed that more than 80% of high net-worth individuals in the Asia Pacific region expected their wealth management relationship to be conducted through digital channels. Based on user research and feedback, the bank successfully created a product-centric Innovation Hub in Singapore to iteratively build a digital private banking solution.

Change the Way Success is Measured

A diverse and empowered product team is invested in the product they are tasked with delivering and will work to sustain growth and relevance as long as customer adoption and feedback justify doing so.

Real innovation means breaking away from the status quo and out of the comfort zone. Narrow business unit-level optimization should not be considered success criteria. Instead, the team puts serious thought into identifying and measuring customer value metrics that communicate meaningful insights regarding the life of their product.

For example, in financial services, the success and value of a payment gateway or trading platform is not measured by how many lines of code were written to make it functional. A more accurate measurement of success lies in the volume of transactions facilitated by the software every day.

Customer-focused metrics are critical for products. However, many traditional organizations still do not encourage their technology divisions to think beyond the iron triangle, where scope, resources, and schedule are the only parameters for quality.

Work Towards a Living Roadmap

Product-oriented teams need to maintain a long-term roadmap and product strategy based on anticipated and visible changes in the market. Teams can plan for governance around staffing, financing and technical strategy. Employing a long-term view helps evolve platforms into ecosystems of services for customers, growing market share.

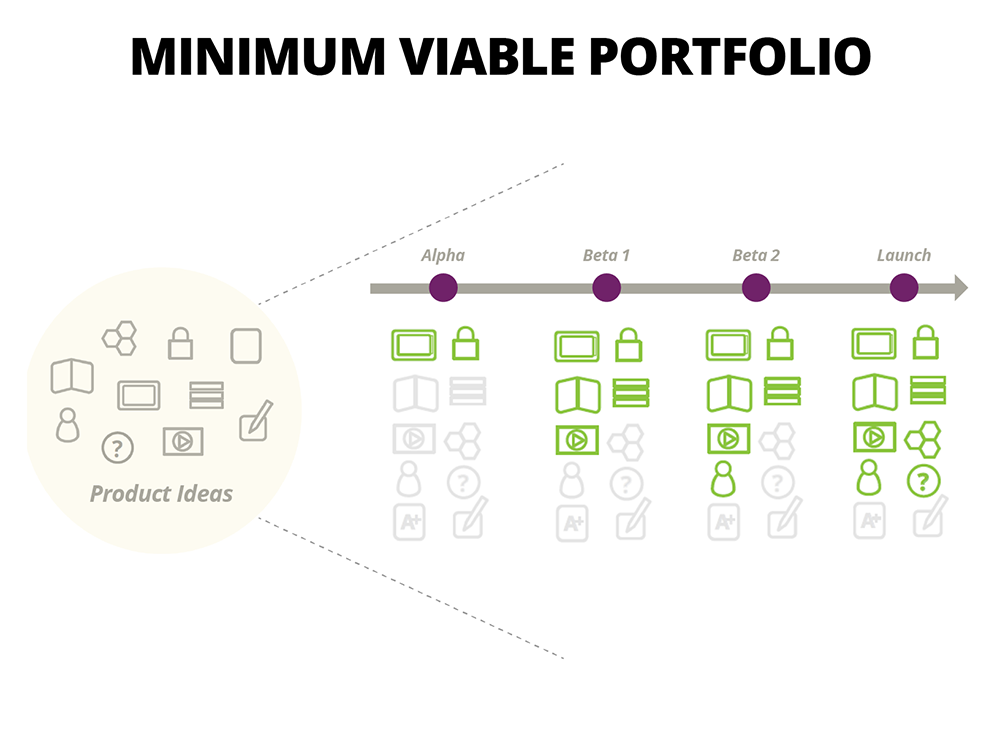

Evolve the product line over time instead of trying to build and release everything at one go. Not every product or product capability needs to be launched at once. Teams should prioritize strategically based on business goals and customer feedback.

A key challenge for innovation is understanding what customers want and aligning your roadmap with their needs. To become innovative in this market, solutions and approaches need to change.

Most large financial firms claim to be innovative in growing new markets. Their technology units show otherwise. They are still wrangled in complex legacy systems and believe in expensive off-the-shelf solutions in potential areas of competitive differentiation. This encourages organizational silos and inhibits the focus needed to create differentiated experiences for their customers.

A successful culture change leads to product teams invested in growing a minimally viable portfolio of products valued by customers and seamlessly integrated with legacy assets.

Disrupt or Be Disrupted

Shifting your organization from a project first to a product first approach may seem daunting at first, but with an agile focus, product teams can be spun up iteratively, frequently validating practices. The same principles used in software development can be leveraged so that financial services organizations too can become lean and innovative.

Some financial service organizations are already making the leap—they are ready to embrace uncertainty in the face of strict regulations to compete with upstarts. In South Africa, we partnered with a large bank to create a bespoke service tailored to new clients and retain existing accounts. The product development process involved transforming the IT department to create business value and delight customers, all while complying with South African Reserve Bank regulations.

Disruption in the wealth management space will inevitably force incumbents to change their portfolio of offerings. The sooner wealth management organizations embrace the need to change, the sooner they can innovate and lead.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.