In the first part of the Payment series, we looked at payments and discussed how the payment channels generally work. In this post, we will explore other types of payments.

Bill Payment

BPAY’s website has this promotional image on its website with the slogan "Switch to BPAY, and make bills work for you".

BPAY is an Australian-centric payment method that allows phone or online banking users to pay their bills through their bank.

Utility (biller) sends a bill to its customer

Customer requests payment of the bill via internet or phone banking

Customer’s bank debits the customer’s account and transmits the payment instruction to the biller’s bank via BPay

BPay receives a fee from both banks per transaction

Biller’s bank credits the biller’s account less fees and informs the biller. The biller’s bank pays the customer’s bank a fee for the role in the transaction

Biller updates its records to reflect the bill as paid

In the above example, Telstra (Australian Electricity Corporation) is sending a BPAY bill to a customer. The customer can pay the BPAY bill with their supported Bank or phone bank. This is just one usage of BPAY and BPAY could be used for any bill/invoice payment.

Within BPAY bill, two pieces of information are critical. One is called BillerCode, which is used to indicate the recipient's information. The other is CRN (Customer Reference Number), which is used to uniquely identify the customer and the bill. Customers are required to enter this information when using the BPAY payment.

BPAY offers a convenient way to pay bills which saves time and effort by providing a centralized platform for bill management. BPAY is widely accepted by a large number of service providers in Australia. Utility companies, telecommunications providers, insurance companies, credit card issuers, and many other businesses offer BPAY as a payment option for bill payment. And BPAY integrates seamlessly with the billing system by service providers.

Overall, the combination of convenience, wide acceptance, biller integration, and payment flexibility has contributed to the popularity of BPAY in Australia. It has become a trusted and preferred method for bill payments, simplifying the lives of individuals and businesses. By the way, many local Australians, especially the elderly, were more willing to accept this payment method.

Check payment

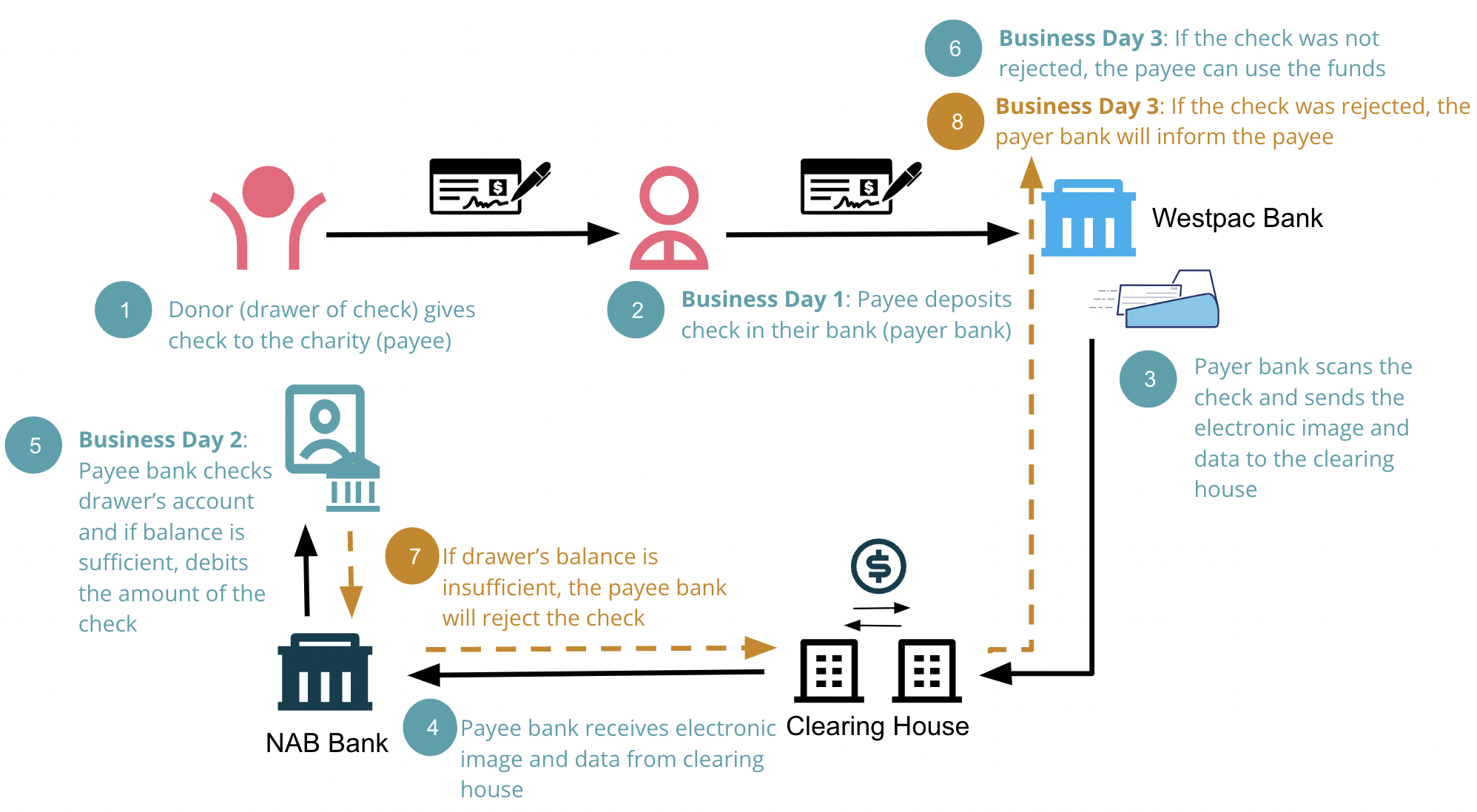

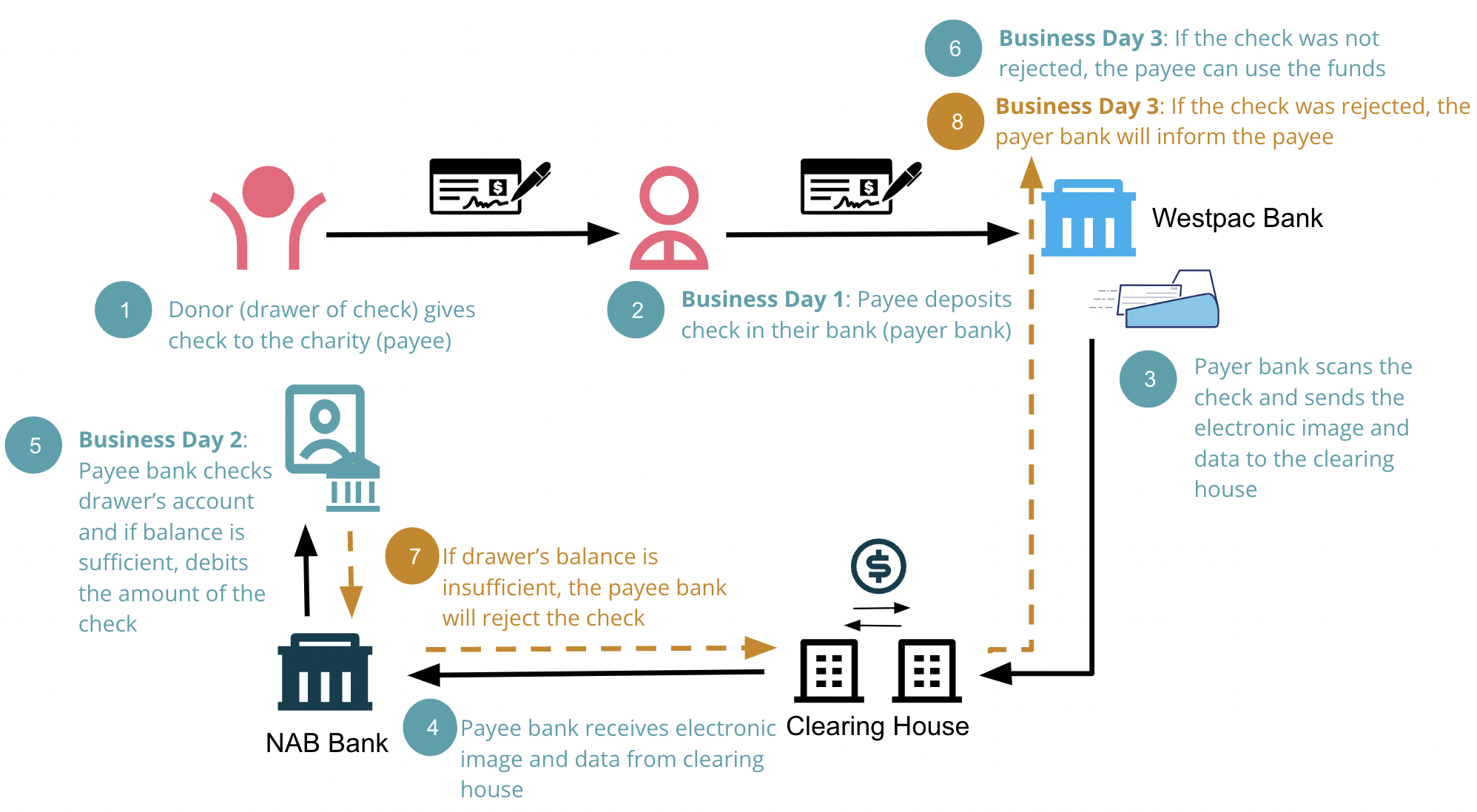

Check payment refers to a kind of document issued by the bank to pay a particular amount of money to the specified payee. Below is a schematic explaining the entire process of check payment.

Donor (drawer of check) gives check to charity (payee)

Business Day 1: Payee deposits check in their bank (payer bank)

Payer bank scans the check and sends the electronic image and data to the clearing house

Payee bank receives electronic image and data from clearing house

Business Day 2: Payee bank checks drawer’s account and if balance is sufficient, debits the amount of the check

Business Day 3: If the check was not rejected, the payee can use the funds

If the drawer’s balance is insufficient, the payee bank will reject the check

Business Day 3: If the check was rejected, the payer bank will inform the payee

Check payment is actually a slower method of payment, and it usually takes three business days to find out if the money has hit the account. This is also the origin of the so-called blank check. No matter what, it takes three days to know the result, so you should also be more careful when receiving a check. A compliant and legal check does not mean that the payment will be successful.

BNPL

BNPL (Buy now pay later) is a payment method that allows consumers to make purchases and defer their payment over time, typically in installments. Some of the more famous BNPL products in Australia are Afterpay, Zip, Klarna.

With BNPL services, consumers can buy products immediately and spread the cost of the purchase over a specific period, often interest-free or with minimal interest charges. Why does it allow you to buy first and then pay afterwards? Does it feel like a credit card?

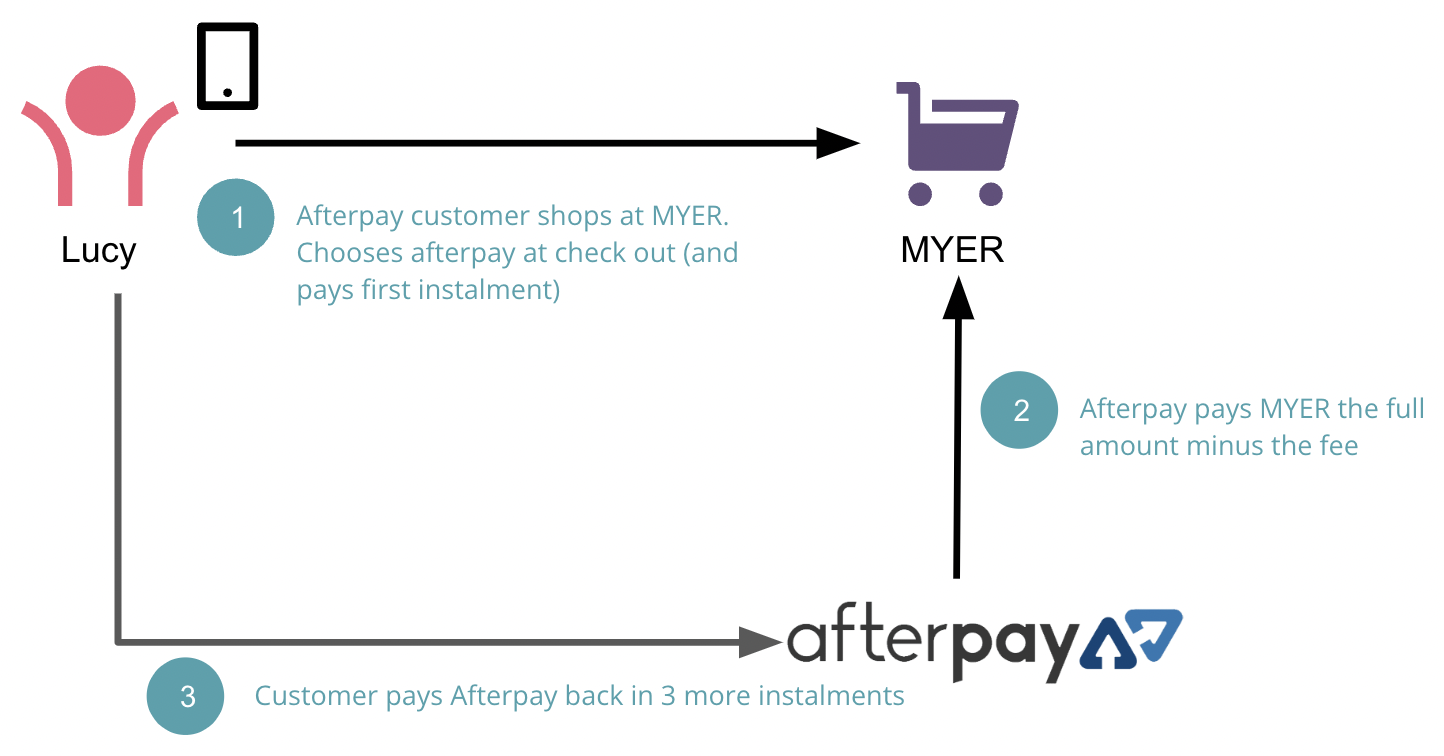

Let's take a look at how Lucy shops with BNPL

As you can see in the picture, Lucy is shopping through MYER's app using BNPL. So even if Lucy doesn't have enough money right now, she can still buy her favorite items first. Afterpay pays for these items first, and then Lucy would pay back the money through installment via card payment, bank fund transfer or BPAY these existing payment ‘rails’.

Of course, BNPL customers can only shop with BNPL- supported merchants that have a contract in place with BNPL companies. There are quite hefty charges for the merchant around 4.17% (compare that to 0.3% when paying with eftpos or 1% paying via Visa credit card). The merchant believes that by not offering BNPL, they might lose revenue.

The rise of BNPL is a good thing for the payment industry as it will lead to credit exposure to a broader customer base. And data shows that credit guarantees are slowly shifting from existing card organizations to BNPL institutions.

Other payment methods

These new payment methods actually use more advanced payment concepts and technologies such as QR codes, e-wallets, NFC, token card payments. When combined with the existing old payment channels, making payments becomes even more convenient and easy.

Online Payment Introduction

Online payment is growing rapidly and becoming a major pillar in the payment field.

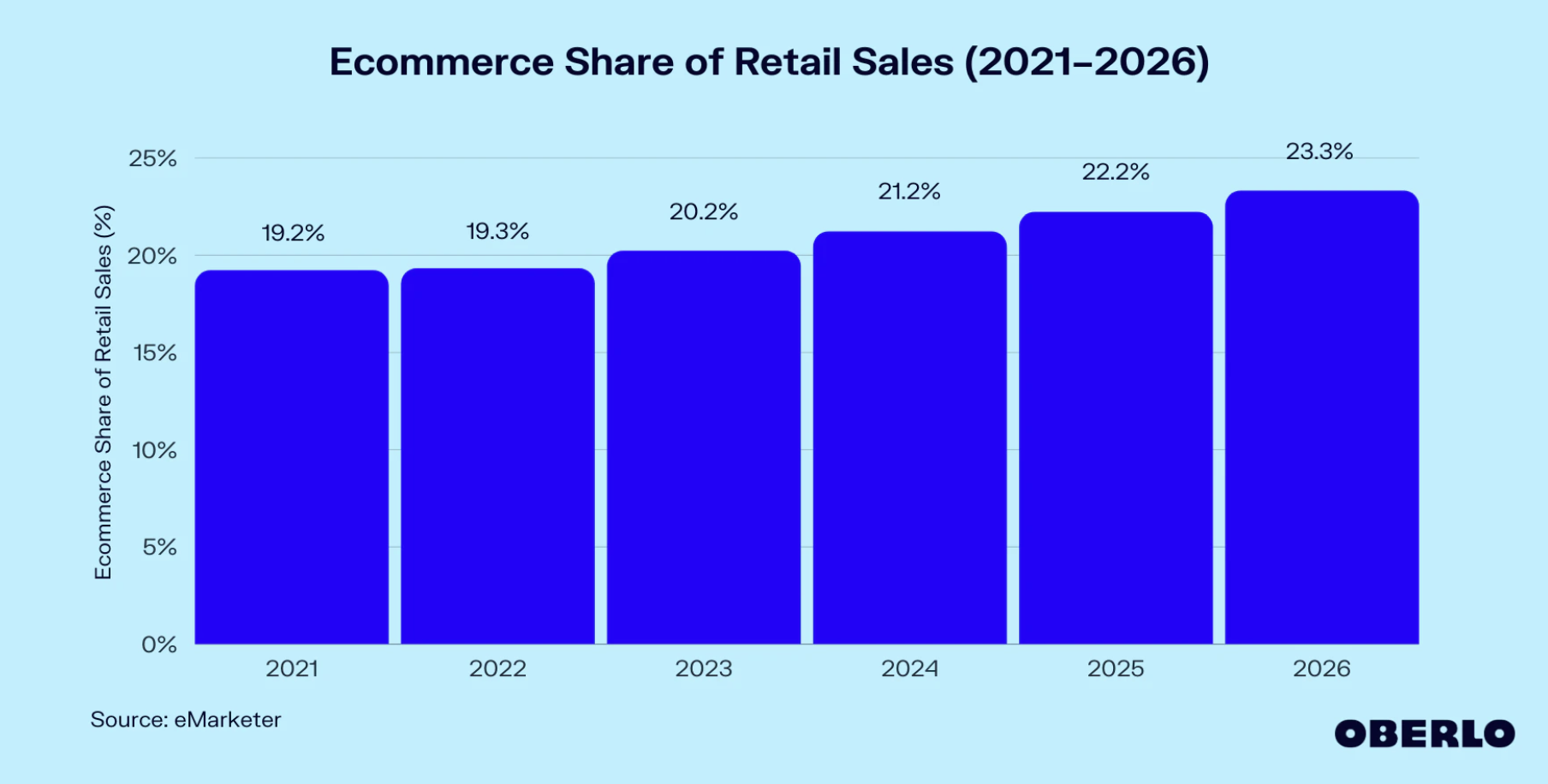

In 2022, the global e-commerce market is around $5.7 trillion and it is expected to reach $8.1 trillion by 2026.

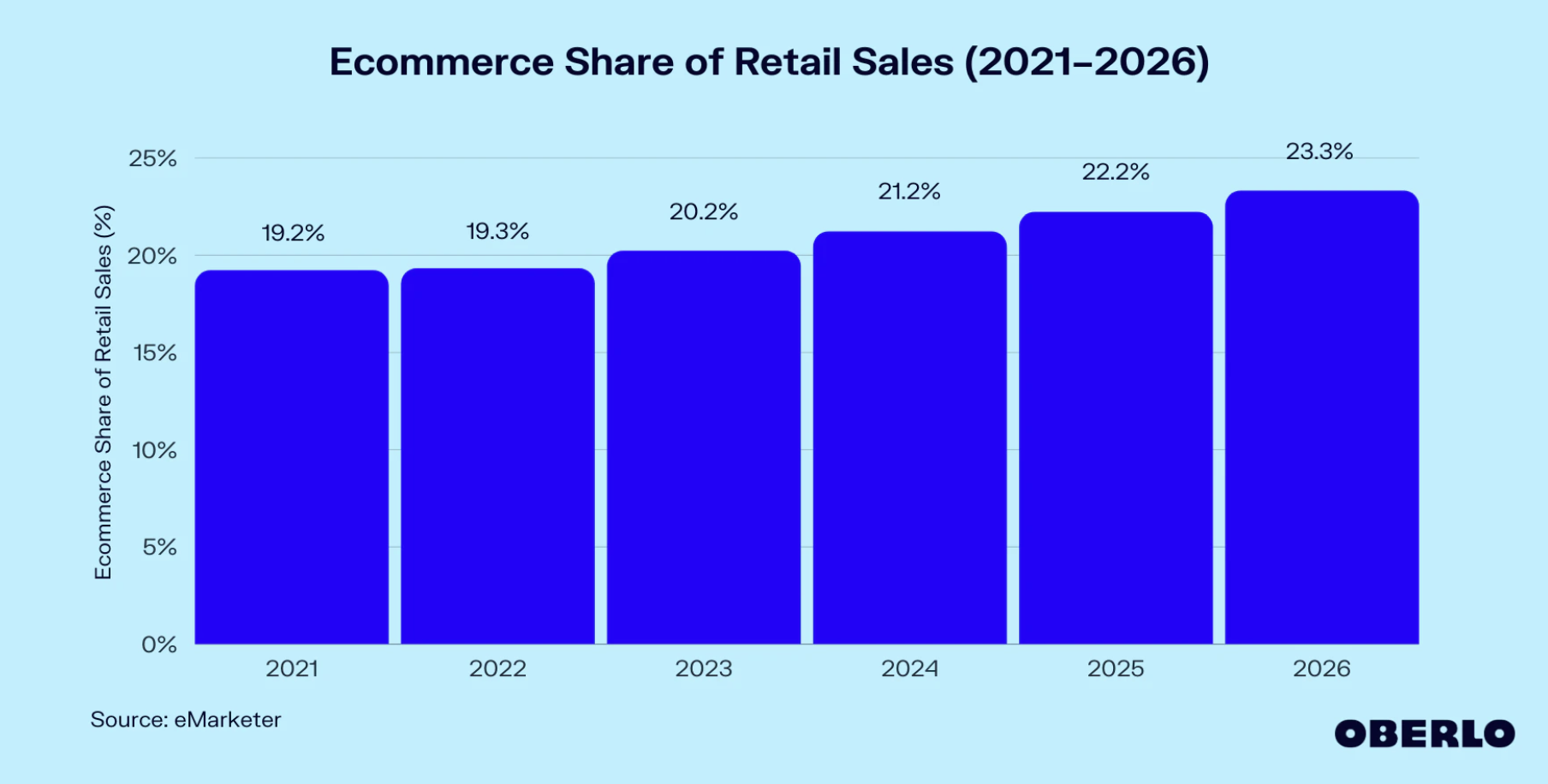

In 2018, online payments accounted for 10% within retail sales. And by the end of 2022, it reached to 20% and it is expected to reach 23% by 2026.

The ease of online shopping considerably increases customers’ desire to make a purchase, which greatly accelerates the growth of online payment.

But as the saying goes, there are two sides to everything. While online payment brings convenience and benefits, it also introduces danger and deception.

Stay tuned for further updates on Payment Fraud and 3DS 2.0.

Disclaimer: The statements and opinions expressed in this article are those of the author(s) and do not necessarily reflect the positions of Thoughtworks.