Few topics have dominated the technology space as much as Generative AI (genAI) in recent years. It has created hype across every sector due to its ability to almost mimic human interaction and generate content on demand — and wealth management is no exception.

GenAI holds immense potential in wealth management, from creating opportunities that transform advisor productivity, to enabling superior client experiences.

Facing headwinds including shrinking margins, rising costs, and technological disruption, not to mention a new generation of millennial investors, wealth management firms are actively seeking ways to improve productivity, enhance the client experience, and reduce costs.

As a result, many firms are starting to experiment with genAI.Morgan Stanley is building solutions that could help advisors with customer servicing and chatbots that could help customers with their queries. On the other hand, JPMorgan Chase & Co. recently announced the launch of IndexGPT leveraging OpenAI’s GPT-4 model to construct thematic investment baskets based on emerging trends, powered by AI-generated keywords extracted from news articles.

While wealth management firms race to implement genAI use cases, it's crucial to first define the desired value, outcomes, and expectations. GenAI should neither be viewed as a panacea to all the industry’s problems, nor be relegated to simply optimizing routine tasks such as customer inquiries or research support.

Thoughtworks believes that the true potential of AI - and when we say AI we include both genAI and predictive AI - can be realized in wealth management firms using a two-pronged strategy that leverages the predictive and analytical capabilities of predictive AI alongside genAI’s potential to synthesize and generate content.

The power of a two-pronged approach to AI in wealth management

Predictive AI analyzes past data, identifies patterns, and assigns probabilities based on which it can make accurate, reliable projections about the future, and recommends the best actions to take given a scenario.

In wealth management firms, common applications for predictive AI include delivering portfolio recommendations, providing personalized advice, and tailoring user experiences to individual customer needs. (If you'd like to learn more about these use cases and what it takes to deliver them, we explore them in detail in our previous article on hyper-personalization).

GenAI, on the other hand, is great at responding to queries. It generates responses or content based on a prompt provided by the user, making it a valuable tool in assisting customers during onboarding, investment education and research.

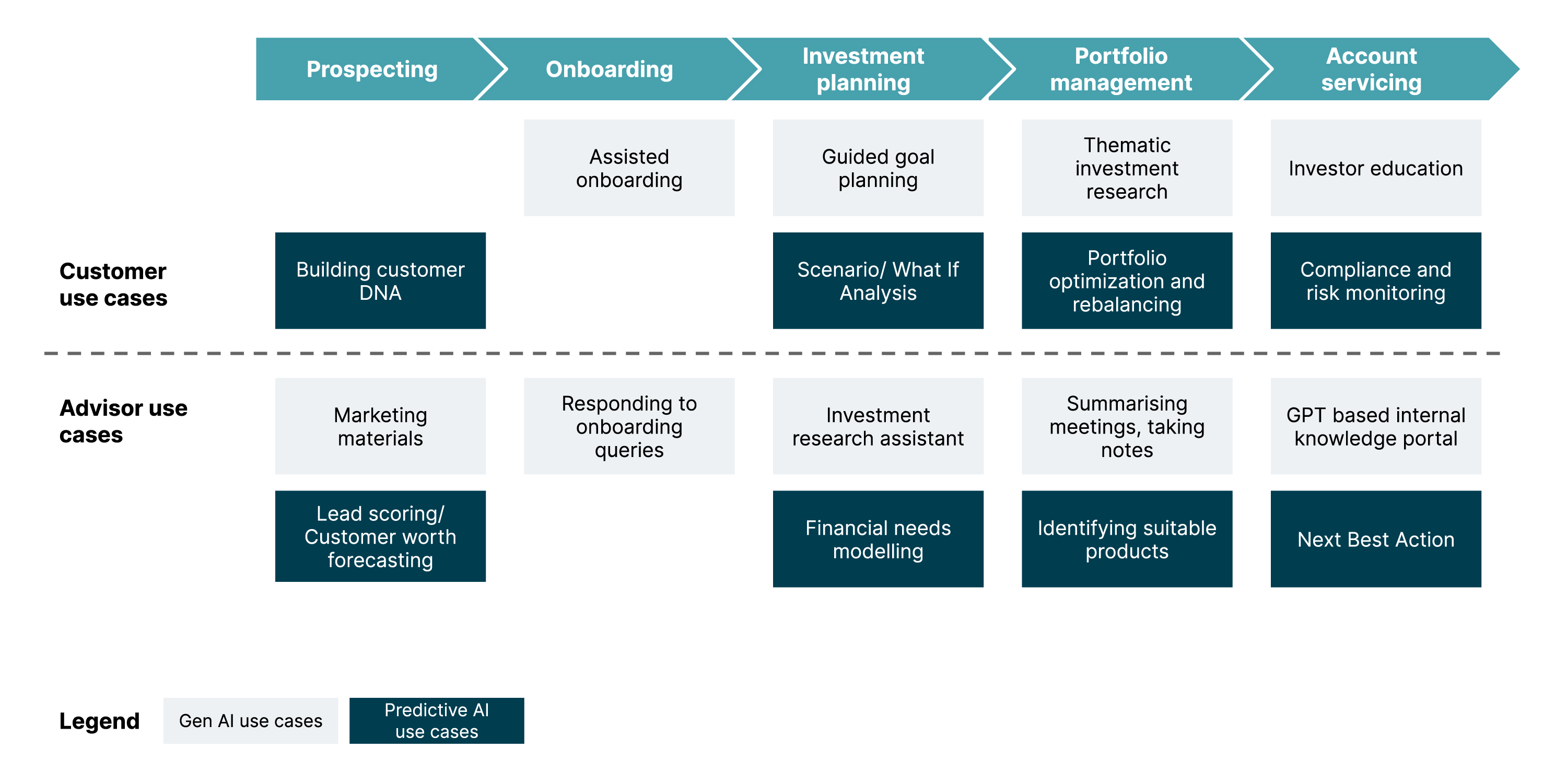

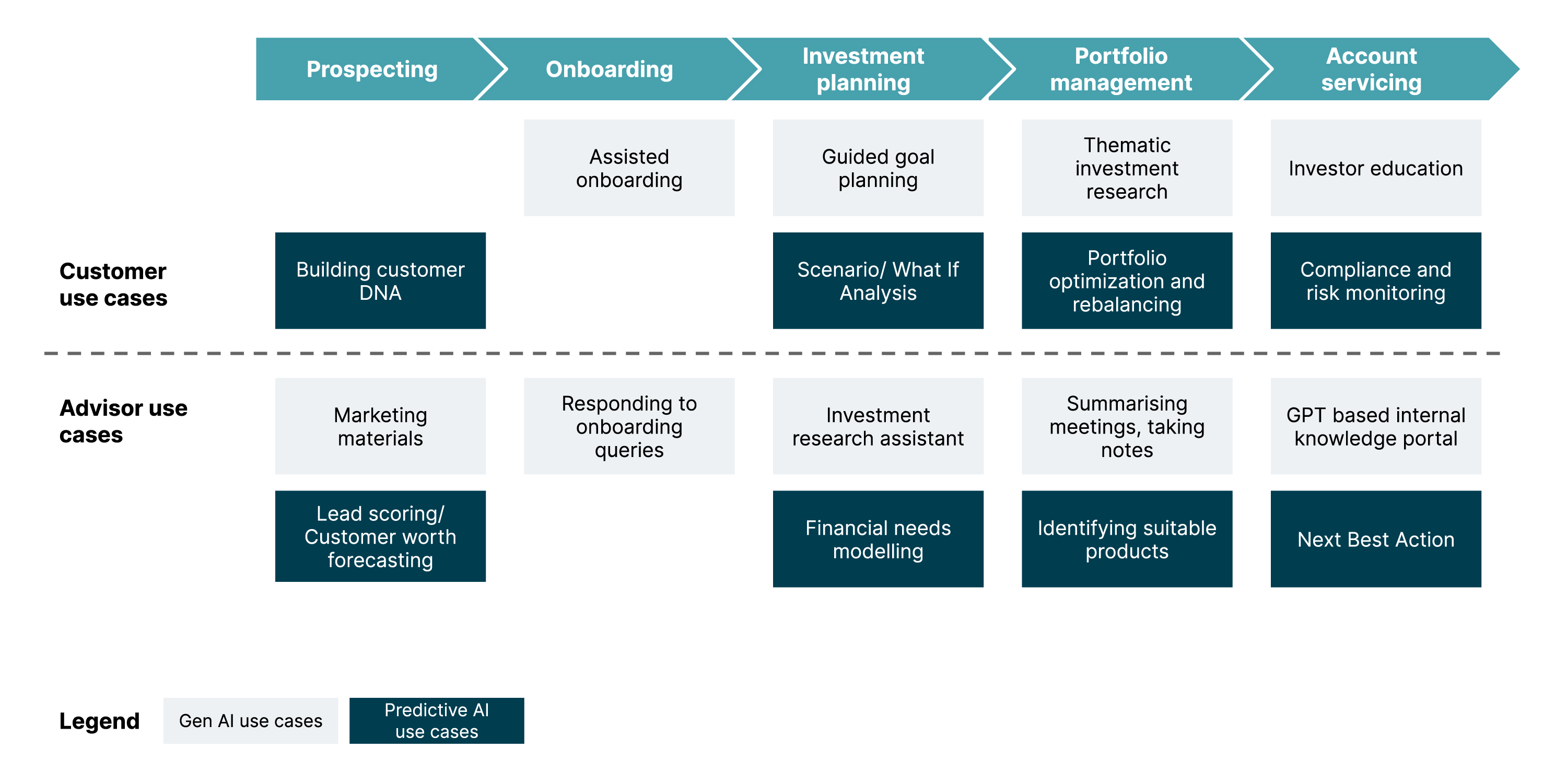

Both types of AI can be applied in different areas of wealth management to solve specific challenges. But together, they have a more far-reaching, transformational impact on how wealth management firms operate, empower advisors, and engage customers. In fact, if we look at the entire wealth management value chain shown in the diagram below, we can find opportunities to leverage genAI along with predictive AI at every step of the process. (Note: This is only an indicative list and there could be several more opportunities across the value chain).

Applying our two-pronged AI approach

To see the impact of this two-pronged approach in action, let's break down the most prominent wealth management use case: investment advisory.

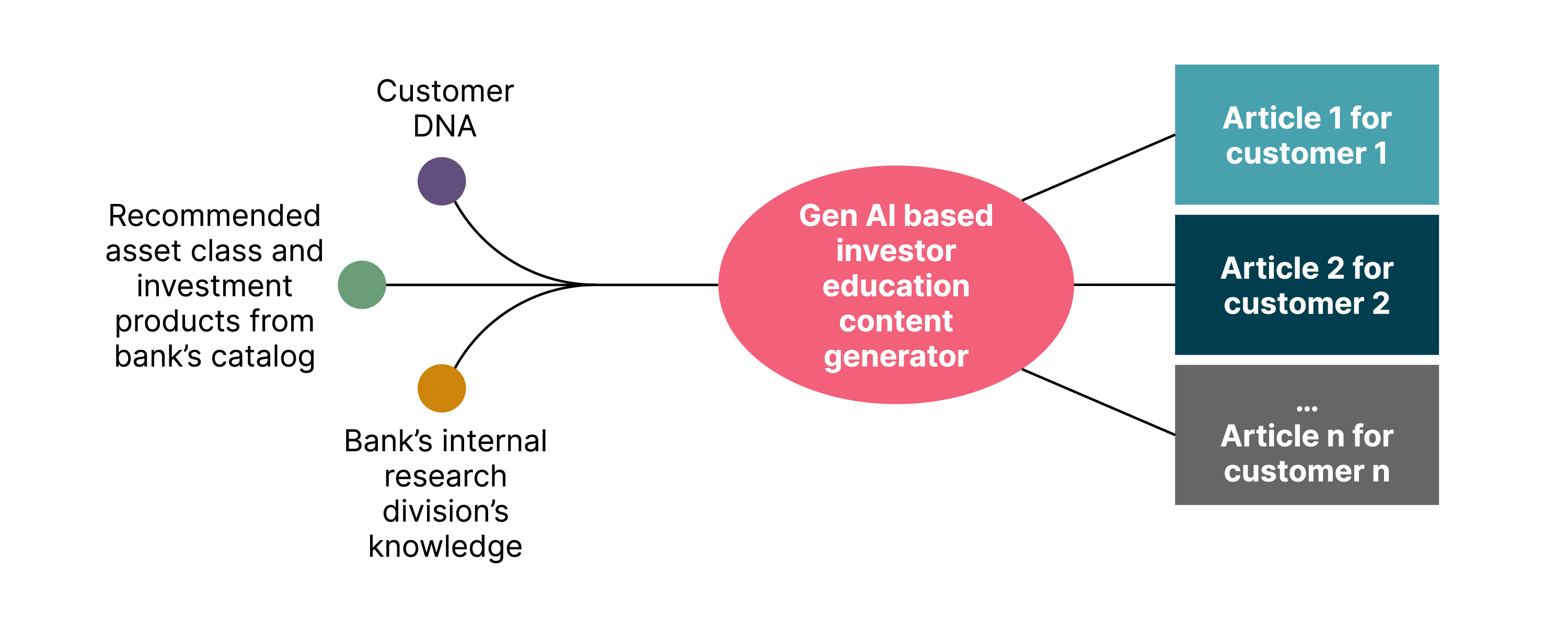

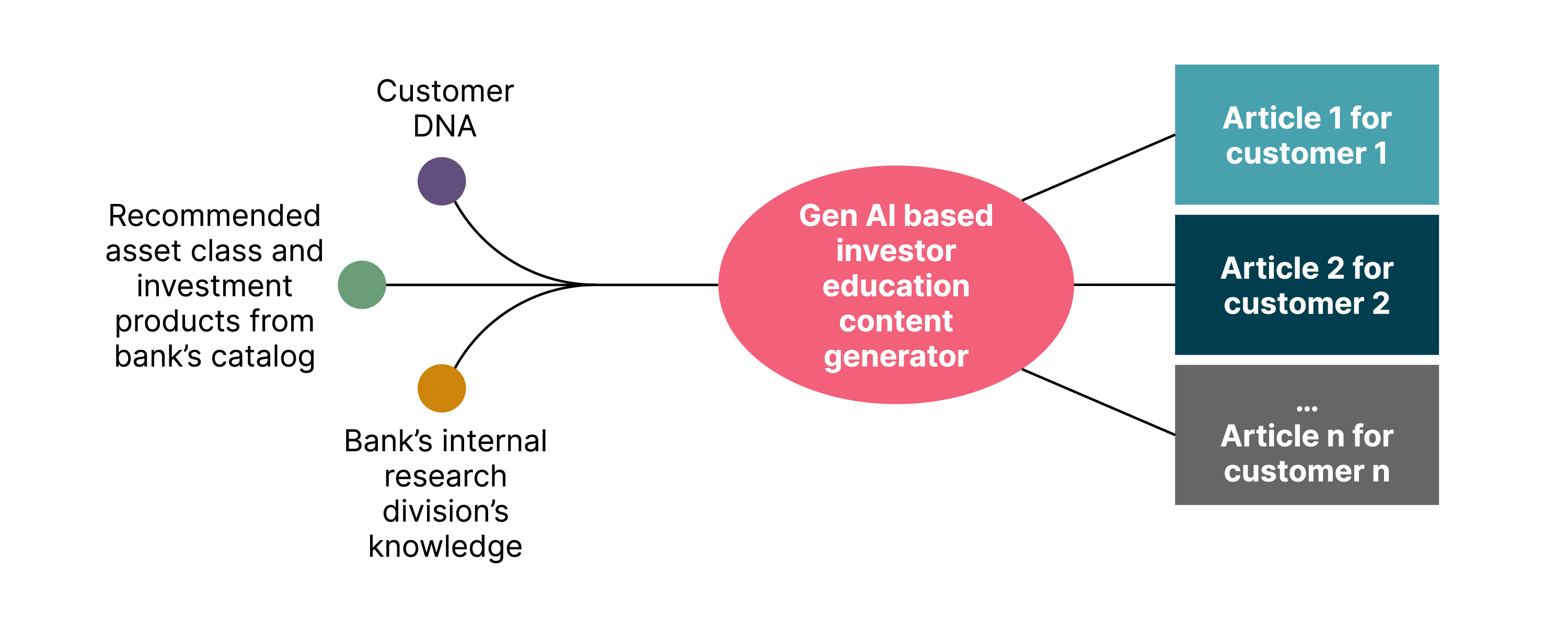

Wealth management firms make specific investment recommendations to their clients from their product catalogue based on their risk profile, existing portfolio, and goals. To complement these recommendations and as a premium value-added offering, firms sometimes provide their clients with research insights and educational content related to their recommendations. This creates a win-win situation for both investors, who are empowered to make informed investment decisions, and firms, who benefit from attracting new clients, retaining existing ones, ensuring regulatory compliance, and promoting financial literacy across their target audience.

However, given that data and predictive AI empowers firms to uniquely identify and understand a customer, it makes more sense for wealth management firms to move beyond their generic investor education content to something more personalized and contextual in order to drive better engagement.

Let's look at the individual predictive and genAI capabilities that will form each of the "prongs" in this example.

- Predictive AI-based automated client segmentation and investment recommendations: As we explored in our previous article, traditional predictive AI enables wealth management firms to view and treat every customer as a segment of one. By analyzing life events and spending patterns, it can differentiate between the financial needs of a 30-year-old single mother and a 30-year-old female entrepreneur living in the same city, and recommend them relevant products.

- GenAI-based content generation: Once predictive AI has helped us determine which product to offer each customer, we can then help the customer understand those products - the nature of investment, its risk parameters and how it fits into their current portfolio. Using genAI, we can generate relevant content that's highly tailored to each customer's priorities, needs, and even content consumption abilities resulting in informed investment decisions.

To further demonstrate our viewpoint, we engaged Google Gemini, a publicly available chatbot powered by generative AI models such as GPT (Generative Pre-trained Transformer), to produce investor education articles on behalf of a bank. We provided two specific customer profiles as input to Gemini, but recommended the same investment product (Fixed Income). We are not reproducing the entire response from Gemini but have included an excerpt below.

Customer profile: 30 year old single mother with limited financial knowledge |

Customer profile: 30 year old female entrepreneur with an existing portfolio of high-risk investments |

| Product: Fixed income investments | Product: Fixed income investments |

Fixed Income Can Be Your Friend

Think of it like this: You loan money to a company or government, and they pay you back with interest over time. That means:

Ready to explore? Talk to a financial advisor for a personalized plan that considers your risk tolerance and dreams for your child's future. |

Diversifying Your Portfolio: Why Fixed Income Can Be Your Ally

As a savvy entrepreneur, you're well aware of market fluctuations and how to navigate them to your advantage. You've likely already built an investment portfolio with growth potential. But have you considered incorporating fixed income products for added stability?

Think of it like this: While growth-oriented investments provide the potential for high returns, they also carry inherent risk. Fixed income products like Bonds, Certificates of Deposit (CDs), High-Yield Savings Accounts act as a counterweight, mitigating volatility and offering reliable income streams. That means:

Mitigating risk: Diversify your portfolio, lessening vulnerability to market fluctuations.

Consistent returns: Earn predictable interest payments to reinvest or act as a financial buffer.

Peace of mind: Focus on growing your business with a secure asset foundation.

Ready to tailor your strategy? Speak to a financial advisor who can help you integrate fixed income into your existing portfolio, maximizing returns while minimizing risk. |

As demonstrated by the above output, genAI's most compelling application lies in its ability to dynamically adapt content based on prompts. These prompts could include customer's demographics, their level of financial literacy, their investment objectives, and their existing portfolio.

An entrepreneur or a single mother who is already attention and time poor is most likely to experience information overload while sifting through financial articles online. This can lead to decision fatigue, meaning they either disengage from making any financial decisions or, worse, choose unsuitable products that can further negatively impact their experience of investing.

Now as a wealth management firm, imagine sending a curated article like the above, instead of irrelevant, boilerplate articles? To further enhance this output for investors who prefer numbers or graphs, performance output numbers and graphs can also be added, as well as links to some of your top-performing fixed income funds. This is more likely to trigger an informed investment decision from the reader.

This is just a glimpse of how predictive and generative AI can be harnessed in tandem. By integrating them throughout the customer value chain, wealth management firms can deliver exceptional value to clients and advisors.

Finding high-value genAI use cases that expand your existing AI-driven wealth offerings

By now, almost all wealth management firms have some form of predictive AI baked into their products and services catalogue. So how do you identify the right genAI use case to build on your existing AI foundation that helps you derive maximum value with minimal disruption?

The right answer will vary between organizations, based on each firm's readiness, technology landscape, goals, and operating model. To find the right use cases for your firm, start by asking these five questions:

Is your firm AI ready?

To make AI generally available within the organization, it’s important to have:

- Clean, self-serve customer and transaction data: accessible through secure, open APIs.

- Reliable data processing: a stable platform for handling large datasets.

- The right team: skilled professionals or partners to implement AI and a culture that fosters human-AI collaboration.

Where can genAI deliver maximum value with the least cost and complexity?

A common mistake organizations make when adopting genAI for the first time is selecting complex use cases. The cost of implementing genAI is still relatively high, so it's essential to balance the projected value a use case could deliver against the cost and complexity of implementing it. High complexity isn't necessarily a bad thing, but it should have some methods of direct monetization so your firm can realize significant ROI from it — such as creating a new fee-based model for personalized AI-generated insights.

How widely can the use case be applied and reused across the firm?

Ideally, firms should start by building genAI use cases that are fundamental enough in terms of touchpoints so that once the capability is built it can be easily reused in different areas. For example, if a capability is built to create content based on customer profiles for investor education, it could also be used to produce marketing content in the future.

What's the cost of making a mistake?

Given that genAI remains a largely exploratory and unregulated space, we recommend that you steer clear of use cases where the consequences of errors and hallucinations are significant.

Can you build out the use case in a secure and compliant way?

Currently, there are no specific and globally standardized regulations solely focused on the use of genAI in the wealth management industry. However, there are several overarching regulations (EU AI Act), frameworks, and ethical guidelines on fairness and non-discrimination (EU Commission's AI for a Human-Centred Society and the OECD's AI Principles) which must be adhered to while using genAI.

Once the use cases have been identified keeping the above questions in mind, it is also important to implement sufficient checks and guardrails to oversee high-impact AI-driven output and decisions, particularly those concerning portfolio recommendations and investment allocation. For instance, automated filter mechanisms can be employed to verify whether the recommended portfolio contains a customer-appropriate mix of asset classes, or to ensure that the recommendations exclude high-volatility instruments.

Four dimensions to address when adopting GenAI

As a relatively new technology, genAI demands close attention to four key dimensions to prevent adverse effects within your organization, and negative customer outputs:

Build the right security measures: Just like predictive AI, genAI will handle a lot of your sensitive customer data. That means you'll need to have the necessary protection layers in place to safeguard your organization and your customers from common LLM-based risks, such as prompt injections, model theft, and sensitive information disclosure.

Avoid biases and toxicity: Due to biases in training data, many genAI models can develop biases and potentially produce toxic content. This might involve recommending certain products only to select genders or making unfair assumptions based on customer demographics. Ensuring bias-free training is very difficult, so we recommend building in strong human validation processes to ensure biased outputs are never published or acted upon.

Optimize your costs: GenAI's costs can rise rapidly, and it won't always be the most cost-efficient way to engage your customers. Think about where you can reduce costs, from compressing the text that goes into your LLM model to choosing use cases with the highest monetization opportunities.

Test for hallucination and factual accuracy: Many LLM models remain prone to hallucinations and generate text that's either factually incorrect or nonsensical. Even after extensive stress testing and training, hallucinations can still happen, which is why we recommend focusing on genAI use cases that don't require 100% accuracy in outputs.

Capitalize on the genAI opportunity in wealth management today

GenAI has created opportunities to drive growth, improve customer experiences, and transform time-consuming tasks like content generation that no wealth management firm can afford to overlook.

With decades of deep AI expertise and experience, Thoughtworks is uniquely positioned to help your organization harness the power of both generative and predictive AI — and combine them to deliver maximum value, ROI, and customer impact.