One of the great promises of the digital economy has been the idea of money changing hands instantaneously, without the bureaucratic, technical or cost hurdles that complicate so many transactions. But only now are interests converging in a way that will soon make this an everyday reality.

It’s easy to see why companies like the idea of instant payments. Eliminating delays means working capital isn’t tied up in slow settlement mechanisms, improving cashflow management. For consumers, instant payments provide the peace of mind that transactions will be processed quickly and transparently, allowing them to track and manage spending more effectively. For governments and central banks, instant payments mean more liquidity flowing through the financial system, helping to drive economic growth.

For banks, though, the benefits have perhaps been less clear. At many financial institutions instant payments can involve yet another overhaul of fragmented legacy systems and infrastructure, with costs that can’t be offset unless and until clear business cases can be built around as-yet untested services.

Banks must also ensure that real-time payments are subject to real-time fraud detection, which can be a challenging technical hurdle. Without this, many customers won’t feel secure enough to use the new technology, while institutions themselves could face penalties if criminal or terrorist groups manage to exploit the loopholes that result.

An emerging ecosystem

So what’s changed? Put simply, while headwinds still exist, the shift to instant payments has hit critical mass. A recent study by Juniper Research forecast the instant payments market will nearly triple from US$22 trillion this year to over US$58 trillion by 2028.

Other forecasts estimate that if European regulators succeed with their planned push, instant payments could rise from 12 percent of transactions in the Euro Single Payment Area to nearly half by 2027. Meanwhile, national regulators are vying to establish their countries as leaders in new payment systems, often as a means to promote the growth of the digital economy and financial inclusion by equipping even individual merchants with bank-like capabilities. Pioneers like Australia, India and Singapore led the charge to create the conditions that enabled instant payments in their markets, placing pressure on peers elsewhere to catch up.

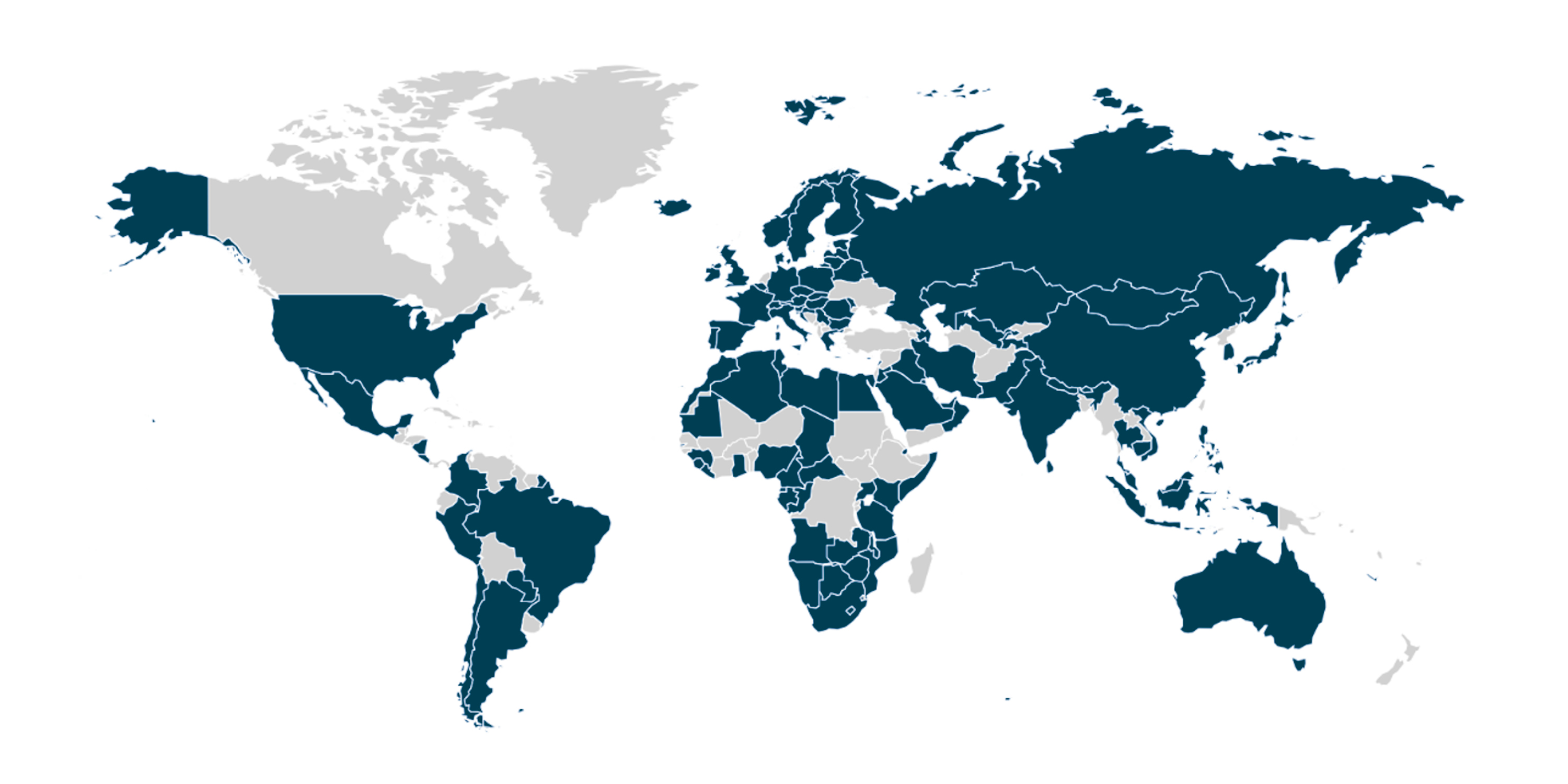

Availability of fast payment systems around the world as at April 2024.

Image source: Reserve Bank of Australia

The Reserve Bank of Australia (RBA), for one, set the goal of instant payments back in 2012 and then invited the industry to work out how it should be done. The result was the New Payments Platform (NPP), an open-access infrastructure that allows payment messages to carry much richer data than before. Use and analysis of this data is in turn creating new business and customer experience optimization opportunities. The RBA built the settlement component itself, but the bulk of investment in the NPP has come from major banks, particularly when it comes to compliance.

Enter the Fed

If momentum was already building, a key development last year was a game-changer. FedNow® - the US Federal Reserve’s new instant payment system - went live, with the participation of 35 banks and credit unions, and 16 service providers to support payment processing.

One year later, those 35 early-adopter banks have become around 800. The Fed says that its system benefits from some ‘second-mover’ advantages, having learned lessons from the pioneers in the Asia-Pacific. For example, it’s touted as the first cloud-native system of its kind, with instances distributed across the US so that if one service provider has a failure, others elsewhere will ensure operational continuity.

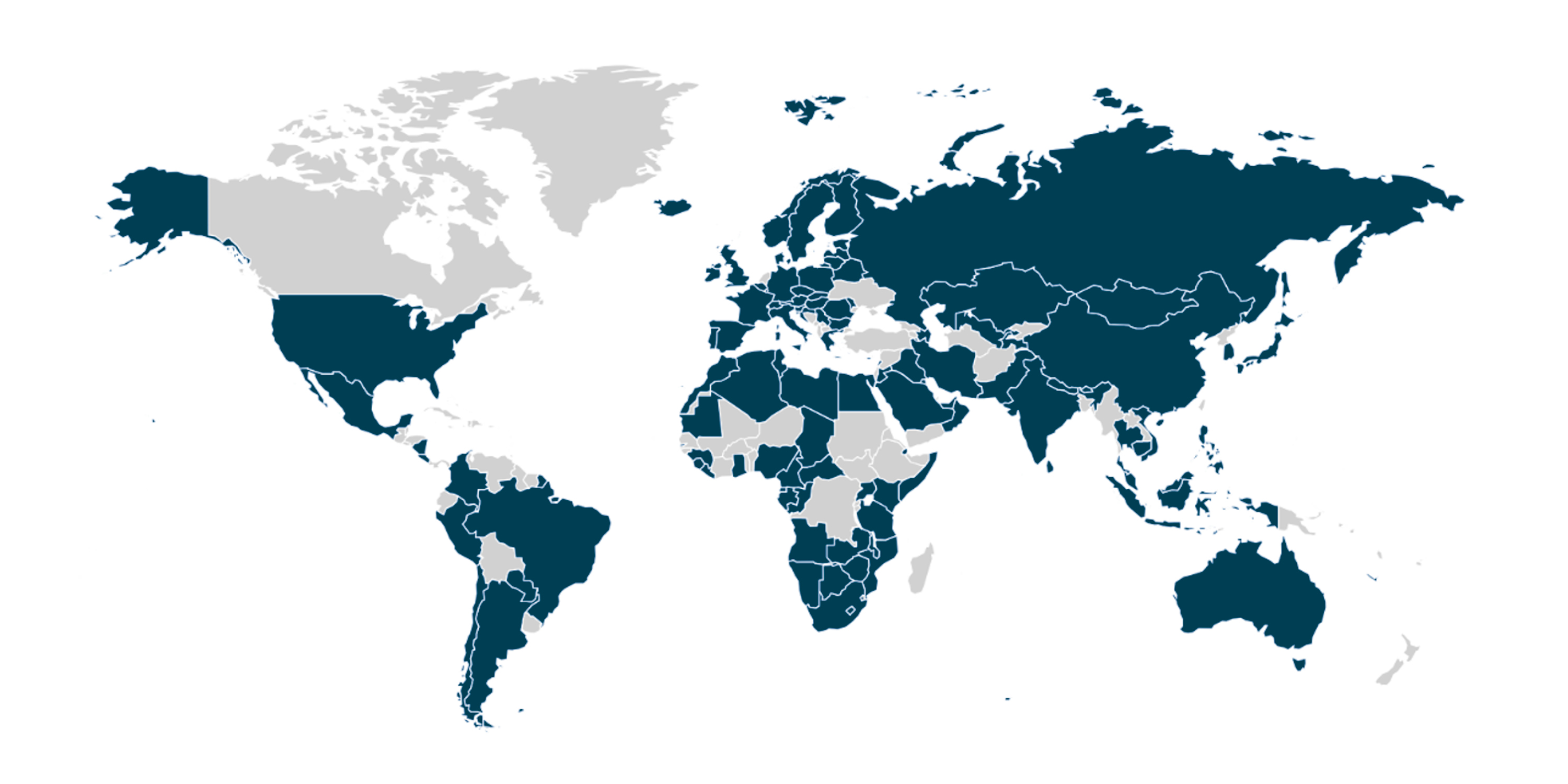

Instant payments are on the rise, driven by government support and customer adoption. Early adopters like Australia, India, Brazil and Singapore are spearheading the development of instant payments in their markets, putting pressure on other countries to follow suit.

The impact of FedNow has been immediate. While still a small proportion of the overall total, the number of instant transactions in the US jumped by 25 percent last year, contributing to a global increase of 42 percent. Interestingly, however, this is one area where the US remains behind many emerging markets; the global leader in instant payments is India, which saw 130 billion such transactions last year. Its recent move to link its Unified Payments Interface (UPI) with PayNow, the equivalent service in Singapore, points to a future where cross-border payments become more mainstream, making it much easier to send and receive money internationally. Brazil’s Pix provides another model for inclusion and rapid adoption, with usage soaring 74 percent last year alone to surpass both debit and credit cards.

To sum up, governments are clearly championing instant payments; customers will become more accustomed to them; and some banks are already benefiting from the speed, operational efficiencies and insights they can bring. Any institution aiming to compete in this rapidly growing market needs to ensure its systems and processes are fit for purpose – and fast.

Making the transition to real-time payments

Having worked closely with regulators and participating banks in India, Australia and Singapore as instant payments took shape in these markets, we’re something of an early mover ourselves. We understand what’s involved and what’s at stake in building a democratic infrastructure to drive collaboration and innovation, and to create best-in-class experiences and architecture that support the scale, complexity and compliance of a real-time payments ecosystem, whether for businesses or consumers.

We also understand the pain points. There’s no denying many institutions are contending with fragmented systems and inadequate architecture, and that modernization can be a major undertaking. The burden of regulation, testing and certification can also be significant, given the need for banks to work with every other participating bank and a number of other actors. As more systems and players enter the space, connectivity and interoperability between platforms are issues that will have to be tackled.

All that said, from what we’ve seen, any technical challenges pale in comparison to the shift that banks need to make in terms of customer experience. Instant payments, coupled with changes in messaging standards, will rewrite both what customers expect and what it’s possible to deliver, requiring services to be conceived and structured in entirely new ways.

The transition to real-time payments presents unique challenges, including outdated systems, complex regulations and interoperability. Despite these hurdles, instant payments have the potential to revolutionize customer expectations, forcing banks to completely rethink their services and how they deliver them.

While previously payments may not have been a key source of revenue, instant payments and the richer data that come with them will represent one of the financial services industry’s greatest stores of value in future. More direct sources of revenue, such as charging merchants, will not always be possible for participants in a real-time payment network. However institutions that adopt a more holistic perspective and commit to innovation will be well positioned to develop promising new income streams around the real-time payment model – a theme we will explore in detail in an upcoming article.

This is why we’re encouraging more banks to take the plunge. We are well-placed to support those making the transition to the more robust, scalable infrastructure and processes that underpin real-time payment capabilities – and embed the resilience needed to support security and compliance in a real-time environment. All of us have a role to play in one of the rare and exciting evolutions that promises to benefit the industry, end-customers and entire economies alike.

Spark the extraordinary power of modern digital payments

When it comes to payments, your customers want simple, secure and seamless. An experience that sparks delight. Discover how we can help you deliver the extraordinary.